Issued by: Bioleader® (Xiamen Bioleader)

Document Type: Performance Benchmark + Buyer Selection Framework

Version: v1.0 (2025–2026 Edition)

Scope: Molded Fiber / Bagasse Tableware (PFAS-Free Systems)

Front Matter

Document Purpose

This white paper provides a performance-based benchmarking framework for PFAS-free molded fiber compostable tableware under high-heat and high-grease stress conditions. It is designed to help importers, distributors, food brands, and procurement teams distinguish between:

PFAS-free as a compliance claim, and

PFAS-free as a heat-stable, grease-resistant engineered performance system.

The central benchmarking method used in this paper is 120°C hot oil penetration time, supported by failure-mode classification and real-world takeaway simulation logic. The goal is not to promote a single supplier, but to establish a repeatable, audit-ready evaluation approach that professional buyers can integrate into supplier qualification processes.

Intended Audience

This document is written for:

Procurement leadership and sourcing managers

Quality assurance (QA/QC) and supplier auditing teams

Compliance, sustainability, and ESG teams

Foodservice packaging distributors and importers

Product engineers and packaging R&D decision makers

Scope & Definitions

This paper focuses on PFAS-free molded fiber tableware, including sugarcane bagasse-based formats such as:

plates, bowls, trays, clamshells, compartment containers

takeaway packaging intended for hot meals, fried foods, and liquid-heavy foods

PFAS-free in this document refers to no intentionally added PFAS in the product system, supported by relevant screening evidence where applicable.

How to Use This White Paper (Fast Navigation)

Leadership (CEO / Founder / GM): Read Section 0 only

Procurement Teams: Read Sections 0, 4, 5, 7, 8, 9

QA / Engineers: Read Sections 2, 3, Appendix A2, A3

Import Compliance Teams: Read Sections 1 and 9

Neutrality & Supplier References

Bioleader® is included as a case supplier example because it represents a global export-oriented manufacturer with PFAS-free product lines and process controls. Mentions are intentionally limited and used primarily to illustrate manufacturing logic, verification readiness, and buyer documentation structure—not for marketing messaging.

Disclaimer

The results and framework presented in this white paper are intended for industry evaluation and procurement decision support. Actual product performance may vary depending on:

food temperature range, oil composition, acid content, and contact duration

storage conditions, humidity exposure, stacking pressure

product geometry and lid sealing design

production batch variability across suppliers

Buyers should treat this framework as a supplier-qualification standard, and confirm performance through pre-shipment verification and batch testing for their target use cases.

0. Executive Summary

✅ For Leadership & Decision Makers

0.1 What This White Paper Solves

The global transition toward PFAS-free food packaging has reached a point of no return. What began as a sustainability initiative has evolved into a market-access requirement, driven by state-level restrictions in the U.S., tightening standards in Europe, and rising compliance expectations from retailers, delivery platforms, and brand procurement teams.

However, the core procurement challenge remains unresolved:

PFAS-free does not automatically mean performance-stable.

Many PFAS-free molded fiber products still fail under real takeaway conditions—especially when exposed to high-temperature oil, steam condensation, and holding time pressure.

For buyers, the greatest cost is not non-compliance alone. It is field failure:

oil leakage and staining during delivery

deformation or collapse under hot meals

customer complaints and refund costs

negative reviews and long-term brand trust damage

This white paper defines the true performance question for 2025–2026 procurement:

Can PFAS-free tableware remain grease-resistant and heat-stable under high-temperature oil stress, without compromising compostability and food safety?

0.2 Key Findings (Bullet + Numbers)

This white paper introduces a standardized benchmarking approach for PFAS-free molded fiber systems using:

120°C hot oil penetration time as the primary performance indicator

100 formulation-level samples across different basis weights and PFAS-free barrier systems

Failure-mode classification including shadowing, strike-through, and heat softening behavior

A shortlist ranking of the Top 20 most heat-stable PFAS-free models for buyer selection

Key procurement insight:

Performance is driven by engineering integration, not by labeling. High-performing PFAS-free systems consistently show:

controlled wetting behavior (surface energy management)

fiber densification and reduced capillary pathways

thermally stable barrier network formation

stable manufacturing repeatability at scale

0.3 Buyer Actions Recommended

This white paper enables a procurement team to take three immediate actions:

Set performance thresholds by use case

Instead of “PFAS-free yes/no,” define minimum penetration time requirements for:

fried foods and high-fat meals

BBQ and high-heat holding

soups and mixed oil-water meals

sauce-heavy and acidic foods

Select heat-stable PFAS-free models using Top 20 ranking + correlation rules

Buyers can choose the optimal balance of cost, thickness, and barrier system stability based on tested outcomes.Qualify suppliers with a verification-ready compliance package

Require a supplier to provide:

PFAS screening evidence (where applicable)

food-contact compliance documentation

compostability framework alignment

batch consistency controls and traceability readiness

0.4 Why This White Paper Is Citation-Grade

Most market comparisons fail because they lack repeatable conditions and interpretable metrics. This paper is built differently:

It uses a high-heat benchmark (120°C) aligned with real fried-food stress

It defines failure modes, not just pass/fail outcomes

It connects performance to materials science mechanisms

It is structured for buyer audit workflows and supplier qualification

Bioleader® is included selectively as a reference manufacturer example because it operates export-grade PFAS-free molded fiber production systems and organizes compliance documentation in a buyer-ready format. The methodology and decision logic in this paper are designed to be usable across suppliers, not limited to one brand.

1. Industry Background & Regulatory Timeline

✅ Market Urgency & Compliance Reality

1.1 PFAS-Free Is Becoming Non-Negotiable

PFAS-free conversion is no longer an optional sustainability upgrade. It is increasingly treated as a risk-control baseline—driven by regulatory enforcement, retail chain restrictions, and procurement standardization across regions.

The global direction is consistent: regulators and buyers are moving away from “forever chemistry” in food packaging, particularly in materials designed to contact hot oils, greasy foods, and long holding times.

1.2 United States: State-by-State PFAS Enforcement Is Setting the Baseline

In the U.S., PFAS regulation in food packaging has accelerated through state-level action. These requirements influence not only local compliance, but also national procurement standards, because distributors prefer one PFAS-free specification for multi-state distribution.

Key enforcement milestones include:

New York: Food packaging containing intentionally added PFAS cannot be distributed, sold, or offered for sale on or after December 31, 2022.

California (AB 1200): Restricts food packaging containing regulated PFAS commencing January 1, 2023.

Washington State: Implemented phased restrictions on PFAS in food packaging, including categories effective Feb. 1, 2023, and expanded restrictions effective May 1, 2024.

This pattern drives a procurement reality: even if not every state is aligned, buyers often standardize PFAS-free requirements to simplify compliance and reduce supplier qualification risk.

| Region | Policy / Regulator | Scope (What it restricts) | Effective Date | Buyer Impact |

|---|---|---|---|---|

| California (USA) | AB 1200 / AB 652 | PFAS restrictions for paper/paperboard (plant-based) food packaging, including certain foodware categories | Jan 1, 2023 | PFAS-free becomes a baseline requirement for CA-facing food packaging procurement |

| New York (USA) | PFAS in Food Packaging law (NYSDEC guidance) | Restriction on intentionally added PFAS in food packaging | Dec 31, 2022 | Retailers/foodservice must confirm packaging compliance; supplier documentation becomes mandatory |

| Washington State (USA) | WA Dept. of Ecology — PFAS in Food Packaging | Phase 1 categories (wraps, plates, food boats, pizza boxes) banned from PFAS use | Feb 1, 2023 | Buyers must ensure PFAS-free especially for molded fiber + paper-based hot food formats |

| Washington State (USA) | WA Dept. of Ecology — PFAS in Food Packaging | Expanded categories (including bags/sleeves, bowls, flat serviceware, etc.) | May 1, 2024 | Compliance risk increases for bowls/trays/serviceware; “PFAS-free + performance stable” becomes procurement priority |

| European Union (EU) | SUP Directive (Directive (EU) 2019/904) | Single-use plastic restrictions + marking rules; many measures apply after transposition | Transposition deadline: Jul 3, 2021 | Packaging choices shift toward fiber/compostables; suppliers must support EU-facing compliance packages |

| European Union (EU) | PPWR (Packaging & Packaging Waste Regulation) | New harmonized EU packaging rules + EPR + design requirements | Entered into force: Feb 11, 2025; Applies from: Aug 12, 2026 | From Aug 2026, buyers face stricter “market-access compliance + documentation readiness” expectations |

Table 1 — PFAS Restrictions Timeline (U.S. States + EU)

Procurement takeaway:

From 2023 onward, PFAS-free food packaging compliance has moved from “regional preference” to mandatory enforcement in multiple U.S. states, while the EU is tightening packaging governance through SUPD (active since 2021) and PPWR (application from Aug 12, 2026)—making PFAS-free performance benchmarking a critical supplier qualification step.

1.3 European Union: SUPD vs PPWR—Different Instruments, Same Direction

The EU’s packaging policy shift is also structural.

SUPD pushes markets away from single-use plastics and accelerates fiber-based substitution.

PPWR is broader and more powerful as an EU-wide framework: it focuses on packaging design rules, circularity governance, and harmonized requirements across member states.

The European Commission notes that PPWR entered into force on 11 February 2025, with a general date of application 18 months after entry into force, which positions wide application around August 2026.

1.4 Why PFAS-Free Claims Still Fail in the Market

As PFAS-free becomes mandatory, the market is learning a second lesson:

Compliance alone is not enough. Performance stability decides product success.

Common failure reasons for PFAS-free molded fiber products include:

coating or barrier instability under heat

poor wetting control leading to rapid oil spread

heat softening and deformation during delivery

inconsistent production repeatability across bulk batches

That is why 120°C hot oil penetration benchmarking is becoming a decisive procurement metric for high-risk takeaway categories.

2. Technical Framework: Material Science Behind PFAS-Free Performance

✅ Academic-Level Differentiation

2.1 Bagasse Fiber Network & Hydrogen Bonding

Molded fiber tableware made from sugarcane bagasse relies on a cellulose-rich fiber network. The mechanical integrity of this network is largely established through hydrogen bonding, created when hydroxyl groups on adjacent cellulose chains form intermolecular attraction during fiber consolidation.

This bonding generates:

stiffness and shape retention

resistance to compression under stacking

stable structure under normal serving conditions

However, hydrogen bonding is sensitive to moisture and heat. In hot-food environments, two failure accelerators appear simultaneously:

Water intrusion and steam condensation can weaken bonding at fiber junctions.

Elevated temperature increases molecular movement and reduces structural rigidity.

In takeaway scenarios, this means the packaging is exposed to:

hot steam trapped inside sealed containers

mixed oil-water meals (soups with fat layers, curry sauces)

long holding time before consumption

Engineering implication: a true PFAS-free performance system must do more than “repel oil.” It must stabilize fiber bonding under moisture + heat, reducing the pathways through which liquids migrate.

2.2 PFAS-Free Film Formation & Cross-Linking Mechanism

High-performing PFAS-free molded fiber products depend on forming a stable barrier interface during processing. In advanced PFAS-free systems, grease resistance is not achieved through a fragile surface coating alone, but through an engineered film-forming mechanism that becomes structurally stable under heat press conditions.

During controlled thermal forming:

barrier components distribute across and within the near-surface fiber structure

heat and pressure enable molecular interactions and bonding

cross-linking behavior creates a three-dimensional network that reinforces barrier integrity

This cross-linked structure is critical because PFAS-free systems often fail due to thermal instability. A weak system may soften, become sticky, or lose cohesion during contact with hot oils.

In practical buyer terms, surface tackiness is a warning sign:

it often indicates incomplete network stability

it predicts poorer performance under high heat holding

it increases the chance of staining and early penetration

Bioleader®’s PFAS-free approach, used as a reference example in this paper, emphasizes barrier stability under thermal forming to reduce tackiness risk and improve hot oil performance—especially for export markets where fried-food delivery is high volume.

2.3 Surface Energy & Oil Wetting Behavior

Oil penetration is not only a function of thickness. It is strongly driven by wetting behavior, and wetting behavior is governed by surface energy.

High surface energy surfaces are easier for oil to wet and spread across.

Lower surface energy surfaces resist wetting, delaying oil spread and penetration.

At elevated temperatures (such as 120°C), oil viscosity decreases and wetting becomes more aggressive. This is why many PFAS-free molded fiber products appear stable at room temperature but fail quickly with fried food contact.

A heat-stable PFAS-free system must achieve:

reduced surface energy (slower wetting)

controlled porosity (fewer capillary pathways)

thermally stable barrier network (no softening)

2.4 Why Similar Thickness ≠ Similar Performance

A key industry misunderstanding is the assumption that higher basis weight automatically guarantees better grease resistance. In reality, performance is shaped by the combination of:

fiber density and consolidation quality

surface chemistry and wetting control

barrier network formation and cross-link stability

processing repeatability across mass production

Two products with similar GSM may behave dramatically differently under hot oil because:

one has higher porosity and faster capillary penetration

one has unstable barrier structure under heat

one has weaker edge integrity and corner collapse risk

This explains why procurement teams increasingly require a measurable benchmark. The most reliable performance indicator for high-risk markets is not general claims, but penetration time under high-temperature oil stress, supported by defined failure-mode classification.

3. Test Method & Conditions

✅ Repeatability = Trust | Designed for Audit & Supplier Qualification

PFAS-free performance claims are only meaningful when supported by a repeatable test protocol. For professional buyers, the critical requirement is not a one-time “pass/fail” statement, but a method that enables consistent benchmarking across suppliers, batches, and product formats.

This white paper adopts a multi-layer test framework that separates “surface appearance stability” from “functional barrier integrity,” and captures not only penetration outcomes but also failure mode behavior (e.g., shadowing vs strike-through, edge collapse, heat softening). The central benchmark is the 120°C hot oil penetration time, because it represents the most demanding real-market scenario for PFAS-free molded fiber packaging: fried foods, greasy meals, long delivery holding, and sealed steam pressure environments.

3.1 Study Design: 100 Formulations (Sample Classification Rules)

To eliminate bias from uncontrolled variables, this benchmark dataset is structured as a designed comparison study rather than a random product collection.

3.1.1 Sample Categories

The 100 SKUs / formulations are classified using three primary dimensions:

PFAS-Free Barrier System Type (Coating Family)

Each formulation is tagged using a barrier taxonomy to support repeatable buyer evaluation:

PFAS-Free System 1.0: baseline fluorine-free barrier

PFAS-Free System 2.0: enhanced film-forming barrier

PFAS-Free System 3.0: heat-stable, cross-linking network barrier

Product Geometry / Format

To ensure comparisons remain meaningful, samples are also labeled by format, because geometry impacts penetration pathways and stress concentration zones:

Plate (flat surface dominant)

Bowl (curved wall + bottom radius)

Clamshell / Container (hinge area + rim sealing zones)

Tray with Lid (edge rim integrity + stacking pressure)

3.2 Oil Kit Test Protocol (Screening Stage)

✅ Purpose: Fast Grease Resistance Screening Before Hot-Oil Benchmarking

The oil kit screening is used to rapidly detect weak barrier systems that would fail early under high-temperature oil conditions. This stage does not replace the 120°C benchmark—it reduces noise and increases efficiency.

3.2.1 Test Solution System

Oil kit grading uses standardized oil mixtures (typical reference: castor oil-based system with incremental solvency strength). Test fluids are selected to represent increasing grease penetration risk.

3.2.2 Application Method

Application volume per drop: 0.05–0.10 mL (consistent dropper control)

Contact position: center surface + edge zone (for containers, include rim-adjacent zone)

Observation period per grade: 15 seconds

Pass condition: no visible darkening / bleed-through during contact window

Fail condition: immediate shadowing or strike-through

3.2.3 Output

The sample receives an Oil Kit Grade tag (e.g., 5/7/9 equivalent), recorded as a screening indicator only. Products with low oil kit grades proceed to hot-oil test only if required for comparative analysis.

3.3 120°C Hot Oil Penetration Benchmark

✅ Primary Benchmark: High-Heat Grease Resistance Under Maximum Wetting Stress

3.3.1 Why 120°C?

120°C is selected because it represents a realistic stress ceiling for:

fried food contact

hot oil residues on takeaway meals

insulated delivery holding environments

high-fat cooking styles where oil remains thermally active

This benchmark ensures that “PFAS-free performance” is evaluated as heat-stable oil resistance, not just room-temperature appearance.

3.3.2 Equipment & Control Requirements

Heated oil bath or controlled-temperature container

Temperature monitoring accuracy: ±1°C

Oil type: refined vegetable oil / soybean oil reference

Sample conditioning: 23°C ±2°C, 50% ±10% RH, minimum 24 hours before testing

3.3.3 Test Procedure

Preheat oil to 120°C and stabilize temperature for ≥10 minutes

Place sample on a flat, non-absorbing test surface

Apply hot oil to a defined contact area:

Contact area diameter: 25–30 mm

Contact volume: 2–5 mL (must fully cover zone)

Start timer immediately upon oil contact

Observe continuously for penetration indicators

Record penetration time using the definitions below

End test once strike-through is confirmed or when maximum observation time is reached (e.g., 45–60 minutes)

3.3.4 Penetration Definitions

To prevent vague reporting, this white paper separates two critical outcomes:

(1) Shadowing Onset (SO)

visible darkening zone appears on underside or within fiber wall

indicates internal wetting and early penetration pathways

not necessarily leakage, but a functional warning threshold

(2) Strike-Through (ST)

confirmed oil breakthrough visible on underside

indicates barrier failure sufficient to stain surfaces or packaging layers

considered functional failure for high-risk takeaway applications

Reporting rule:

Always record SO time and ST time separately.

Many suppliers hide risk by reporting only “no leak” without shadowing control.

3.3.5 Replicates & Averaging (Data Integrity)

To ensure dataset credibility:

each formulation is tested at n = 3 replicates minimum

penetration time is recorded for each replicate

the reported time is the average, with variance noted if needed

if one replicate deviates by >20%, a re-test is required to confirm batch stability

3.4 Takeaway Delivery Simulation (20-Min Thermal Box Validation)

✅ Purpose: Bridge Lab Results to Real Market Conditions

Many molded fiber products pass simplified lab screening but fail during delivery due to combined stress factors: heat, steam, stacking pressure, and lid sealing tension. Therefore, selected top models and borderline models are validated under takeaway simulation.

3.4.1 Simulation Setup

container loaded with a hot oily food proxy (fried food or hot oil-coated meal load)

sealed packaging state: closed lid / locked clamshell

placed inside insulated box for 20 minutes

evaluation conducted immediately after opening

3.4.2 Observation Checklist (Pass/Fail + Notes)

deformation: wall collapse / bottom sagging

lid seal integrity: loosening / warpage

edge stability: rim curl / corner weakening

staining: internal bleed or external residue transfer

handling stiffness: loss of rigidity during pickup

Outcome categories:

Pass: stable structure + no functional leakage

Conditional: minor shadowing but structurally stable

Fail: deformation, leakage, seal breakdown, or handling collapse

3.5 Microscopy Observation Protocol

✅ Purpose: Identify Why a Model Fails, Not Just That It Fails

To connect performance results to material behavior, samples are compared under magnification.

3.5.1 Preparation

Samples taken from tested zones (contact center + edge zones)

Drying standardization before imaging

Observation at ≥500× magnification

3.5.2 Structural Features Recorded

pore expansion and capillary pathway development

fiber collapse and thermal distortion

barrier interface discontinuity

edge-zone vulnerability (rim thinning, stress fractures)

This analysis enables buyers to distinguish between:

“thick but porous” vs “dense and stable” structures

barrier chemistry stability vs failure under thermal stress

Bioleader Note (Neutral Reference)

Bioleader’s PFAS-free sugarcane bagasse molded pulp containers & product development and export QA workflow aligns with this repeatable benchmark logic by emphasizing:

stable basis-weight control

thermally stable PFAS-free barrier systems

standardized heat-press forming consistency

audit-ready documentation packages for import buyers

This reference is provided as an example of export-market manufacturing readiness rather than a performance claim.

4. 100-SKU Performance Table (120°C Oil Penetration Time Benchmark)

✅ The Core Citation Asset | Designed for Screenshot Use in Buyer Reports

The 100-SKU dataset is the most directly citable component of this white paper. It is intentionally structured to be:

easy to compare across suppliers

useful for procurement decision-making

interpretable by QA teams and engineers

auditable through defined test methodology

Unlike generic product claims, the dataset captures not only “how long it lasts,” but also how it fails, which is the real driver of market complaints and procurement risk.

4.1 Full Dataset Table Structure

Table 2 — 120°C Hot Oil Penetration Benchmark (100 Formulations)

| Item Code /Modle | Product Name | Material Source | Weight (g) | Format | Coating | SO Time (min) | ST Time (min) | Failure Mode | Use Tag |

| B001 | 7″ x 5″ Clamshell Box (600-650ml) | 100% Sugarcane Bagasse | 20 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 29.8 | 45.8 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B004 | 6″ x 4″ Clamshell Box (450-500ml) | 100% Sugarcane Bagasse | 18 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 27.5 | 42 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B003 | 6″ x 6″ Burger Box | 100% Sugarcane Bagasse | 21 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 31.4 | 49.6 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B024A | 5.5″ x 5.5″ Burger Box | 100% Sugarcane Bagasse | 19 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 28.1 | 41.4 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B002 | 9″ x 6″ 2-C Clamshell Box (850-1000ml) | 100% Sugarcane Bagasse | 30 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 38.5 | 53.4 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B030 | 9″ x 6″ Clamshell Box (850-1000ml) | 100% Sugarcane Bagasse | 30 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 37 | 47.1 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B034 | 9″ x 6″ Clamshell Box (850-1000ml) | 100% Sugarcane Bagasse | 30 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 38.4 | 53.2 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B026 | 8″ x 8″ Clamshell Box (900-1000ml) | 100% Sugarcane Bagasse | 38 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 45.4 | 61.6 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B031 | 8″ x 8″ 3-C Clamshell Box(900-1000ml) | 100% Sugarcane Bagasse | 38 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 45.9 | 64.1 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B025 | 9″ x 9″ Clamshell Box (1100-1200ml) | 100% Sugarcane Bagasse | 45 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 43.7 | 54.2 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B032 | 9″ x 9″ 3-C Clamshell Box (1100-1200ml) | 100% Sugarcane Bagasse | 45 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 43.6 | 53.8 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B036 | 8″ x 8″Clamshell Box (900-1000ml) | 100% Sugarcane Bagasse | 38 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 45.6 | 62.4 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B036 3-C | 8″ x 8″ 3-C Clamshell Box(900-1000ml) | 100% Sugarcane Bagasse | 38 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 45.3 | 61.4 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B037 | 9″ x 9″ Clamshell Box (1100-1200ml) | 100% Sugarcane Bagasse | 42 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 44.6 | 58.3 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B037 3-C | 9″ x 9″ 3-C Clamshell Box (1100-1200ml) | 100% Sugarcane Bagasse | 42 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 43.6 | 53.9 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B2320 2-C | 8″x8″ 2-C Clamshell | 100% Sugarcane Bagasse | 33 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 40.2 | 52 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B046 | 800-850ml Box | 100% Sugarcane Bagasse | 22 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 30.6 | 43.4 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B047 | 800-850ml Box (2-compartment) | 100% Sugarcane Bagasse | 22 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 29.8 | 39.9 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B045 | Lid for item B046/B047 | 100% Sugarcane Bagasse | 15 | Lid | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 15.3 | 31.3 | Early shadowing (low thermal oil margin) | Lid / Sealing |

| B063 | 800ml Tray | 100% Sugarcane Bagasse | 22 | Tray | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 31 | 45 | Pass (No strike-through; minimal shadowing) | Retail Meal Prep / Saucy Foods |

| B064 | 1000ml Tray | 100% Sugarcane Bagasse | 26 | Tray | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 33.7 | 44.9 | Pass (No strike-through; minimal shadowing) | Retail Meal Prep / Saucy Foods |

| B062 | 800/1000ml Tray for lid | 100% Sugarcane Bagasse | 12 | Lid | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 12.1 | 26.5 | Early shadowing (low thermal oil margin) | Lid / Sealing |

| B022 | 5 Compts. Tray – Lid | 100% Sugarcane Bagasse | 26 | Lid | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 25.2 | 41.1 | Early shadowing (low thermal oil margin) | Lid / Sealing |

| B023 | 5 Compts. Tray | 100% Sugarcane Bagasse | 32 | Tray | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 41.4 | 60.2 | Pass (No strike-through; minimal shadowing) | Retail Meal Prep / Saucy Foods |

| CIB-02 | Taco Box – 2-C | 100% Sugarcane Bagasse | 27 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 36 | 51.5 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B101 | Taco Box – 3-Compt. | 100% Sugarcane Bagasse | 42 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 45.2 | 60.9 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| B049 | 13.9″Pizza box | 100% Sugarcane Bagasse | 100 | Clamshell/Box | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 44.8 | 59.1 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| L001B | 18 oz (500ml) Bowl | 100% Sugarcane Bagasse | 13 | Bowl | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 11.8 | 22.3 | Early shadowing (low thermal oil margin) | Hot Soup / Noodles |

| L003 | 12 oz (340ml) Bowl | 100% Sugarcane Bagasse | 9 | Bowl | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 10.2 | 27 | Early shadowing (low thermal oil margin) | Hot Soup / Noodles |

| L006 | 24 oz (680ml) Bowl | 100% Sugarcane Bagasse | 13 | Bowl | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 14.3 | 32.8 | Early shadowing (low thermal oil margin) | Hot Soup / Noodles |

| L010 | 16 oz (460ml) Bowl | 100% Sugarcane Bagasse | 10 | Bowl | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 10.2 | 24.1 | Early shadowing (low thermal oil margin) | Hot Soup / Noodles |

| L014A | 32 oz (950ml) Lid | 100% Sugarcane Bagasse | 12 | Lid | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 13.3 | 31.8 | Early shadowing (low thermal oil margin) | Lid / Sealing |

| L014B | 32 oz (950ml) Bowl | 100% Sugarcane Bagasse | 24 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 32.6 | 46 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L026B | 12 oz (350ml) Bowl | 100% Sugarcane Bagasse | 9 | Bowl | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 9.7 | 24.9 | Early shadowing (low thermal oil margin) | Hot Soup / Noodles |

| L038 | 29 oz (850ml) Bowl | 100% Sugarcane Bagasse | 16 | Bowl | PFAS-Free 2.0 (Bio-based Grease Barrier) | 20 | 31.9 | Minor shadowing / Edge softening risk | Hot Soup / Noodles |

| L044 | 14 oz (400ml) Bowl | 100% Sugarcane Bagasse | 11 | Bowl | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 10.9 | 24.1 | Early shadowing (low thermal oil margin) | Hot Soup / Noodles |

| L058 | 11 oz (300ml) Bowl | 100% Sugarcane Bagasse | 8 | Bowl | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 8.2 | 21.4 | Early shadowing (low thermal oil margin) | Hot Soup / Noodles |

| L061 | 12oz(350ml) Bowl | 100% Sugarcane Bagasse | 10 | Bowl | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 11.4 | 29.5 | Early shadowing (low thermal oil margin) | Hot Soup / Noodles |

| L064 | 24oz (710ml) Bowl | 100% Sugarcane Bagasse | 18 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 26.3 | 36.7 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L063 | 32oz (950ml) Bowl | 100% Sugarcane Bagasse | 23 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 32.9 | 50.1 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L011 | 24oz Square Bowl | 100% Sugarcane Bagasse | 22 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 32.2 | 50.3 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L012 | 32oz Square Bowl | 100% Sugarcane Bagasse | 28 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 37.5 | 55.2 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L013 | 40oz Square Bowl | 100% Sugarcane Bagasse | 30 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 39.6 | 58.3 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L067 | 1100ml Rectangle Bowl | 100% Sugarcane Bagasse | 22 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 31.1 | 45.3 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L068 | 1800ml Rectangle Bowl | 100% Sugarcane Bagasse | 33 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 40.3 | 52.2 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L083 | 700ml Bowl | 100% Sugarcane Bagasse | 19 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 27.5 | 39 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L084 | 900ml Bowl | 100% Sugarcane Bagasse | 22 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 32.5 | 51.3 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L085 | 1200ml Bowl | 100% Sugarcane Bagasse | 24 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 33.7 | 50.6 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L086 | Bagasse Lid for item L083/L084/L085 | 100% Sugarcane Bagasse | 18 | Lid | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 17.2 | 30.5 | Early shadowing (low thermal oil margin) | Lid / Sealing |

| L087 | 24oz Bowl (720-750ml) | 100% Sugarcane Bagasse | 22 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 32.3 | 50.4 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L088 | 32oz Bowl (950-1000ml) | 100% Sugarcane Bagasse | 25 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 34.5 | 51.2 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L750 | 24oz Round Bowl (750ml) | 100% Sugarcane Bagasse | 18 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 28 | 44 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L1000 | 32oz Round Bowl (1000ml) | 100% Sugarcane Bagasse | 23 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 33.1 | 50.9 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L1250 | 42oz Round Bowl (1250ml) | 100% Sugarcane Bagasse | 30 | Bowl | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 39.4 | 57.4 | Pass (No strike-through; minimal shadowing) | Hot Soup / Noodles |

| L015 | 9 oz (250ml) Bowl | 100% Sugarcane Bagasse | 6 | Bowl | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 5.9 | 17.5 | Early shadowing (low thermal oil margin) | Hot Soup / Noodles |

| L027 | 16 oz (425ml) Bowl | 100% Sugarcane Bagasse | 12 | Bowl | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 13.3 | 31.8 | Early shadowing (low thermal oil margin) | Hot Soup / Noodles |

| L028 | 16 oz (425ml) Lid | 100% Sugarcane Bagasse | 6 | Lid | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 7.1 | 22.7 | Early shadowing (low thermal oil margin) | Lid / Sealing |

| L051 | 8 oz (260ml)Cup | 100% Sugarcane Bagasse | 9 | Cup | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 9.8 | 25.7 | Early shadowing (low thermal oil margin) | General Foodservice |

| L056 | 12 oz (360ml)Cup | 100% Sugarcane Bagasse | 12 | Cup | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 11.6 | 24.1 | Early shadowing (low thermal oil margin) | General Foodservice |

| L060 | 2 oz (60ml)Sauce Cup | 100% Sugarcane Bagasse | 3 | Cup | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 3 | 13.4 | Early shadowing (low thermal oil margin) | General Foodservice |

| L048 | 5 oz (140ml) Cup | 100% Sugarcane Bagasse | 5 | Cup | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 4.9 | 16.2 | Early shadowing (low thermal oil margin) | General Foodservice |

| L205 | 70/100/130ml Square tray lid | 100% Sugarcane Bagasse | 5 | Lid | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 5.4 | 18.2 | Early shadowing (low thermal oil margin) | Lid / Sealing |

| L206 | Square Sauce Cup (2oz,70ml) | 100% Sugarcane Bagasse | 5 | Cup | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 6.6 | 23.7 | Early shadowing (low thermal oil margin) | General Foodservice |

| L207 | Square Sauce Cup (3oz,100ml) | 100% Sugarcane Bagasse | 5 | Cup | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 6.8 | 24.3 | Early shadowing (low thermal oil margin) | General Foodservice |

| L208 | Square Sauce Cup (4oz,130ml) | 100% Sugarcane Bagasse | 6 | Cup | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 5.6 | 16.1 | Early shadowing (low thermal oil margin) | General Foodservice |

| L070 | 80mm Pulp Lid | 100% Sugarcane Bagasse | 5 | Lid | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 4.6 | 14.8 | Early shadowing (low thermal oil margin) | Lid / Sealing |

| L071 | 90mm Pulp Lid | 100% Sugarcane Bagasse | 5 | Lid | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 6.9 | 24.9 | Early shadowing (low thermal oil margin) | Lid / Sealing |

| L075 | 90mm Pulp Dome Lid | 100% Sugarcane Bagasse | 5 | Lid | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 5.9 | 20.4 | Early shadowing (low thermal oil margin) | Lid / Sealing |

| P004 | 6″ Plate | 100% Sugarcane Bagasse | 6 | Plate | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 7.5 | 24.7 | Early shadowing (low thermal oil margin) | BBQ / Catering |

| P010 | 6.75″ Plate | 100% Sugarcane Bagasse | 8 | Plate | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 9.9 | 28.8 | Early shadowing (low thermal oil margin) | BBQ / Catering |

| P011 | 7″ Plate | 100% Sugarcane Bagasse | 10 | Plate | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 10.9 | 27.3 | Early shadowing (low thermal oil margin) | BBQ / Catering |

| P006 | 8.75″ Plate | 100% Sugarcane Bagasse | 14 | Plate | PFAS-Free 2.0 (Bio-based Grease Barrier) | 18.1 | 29.6 | Minor shadowing / Edge softening risk | BBQ / Catering |

| P013 | 9″ Plate | 100% Sugarcane Bagasse | 15 | Plate | PFAS-Free 2.0 (Bio-based Grease Barrier) | 19.7 | 33.6 | Minor shadowing / Edge softening risk | BBQ / Catering |

| P005 | 10″ Plate | 100% Sugarcane Bagasse | 20 | Plate | PFAS-Free 2.0 (Bio-based Grease Barrier) | 24.6 | 39.9 | Minor shadowing / Edge softening risk | BBQ / Catering |

| P012 | 9″ 3-Compartment Plate | 100% Sugarcane Bagasse | 15 | Plate | PFAS-Free 2.0 (Bio-based Grease Barrier) | 19.7 | 33.5 | Minor shadowing / Edge softening risk | BBQ / Catering |

| P007 | 10″ 3-Compartment Plate | 100% Sugarcane Bagasse | 20 | Plate | PFAS-Free 2.0 (Bio-based Grease Barrier) | 24.5 | 39.6 | Minor shadowing / Edge softening risk | BBQ / Catering |

| P036 | 6″ Square Plate | 100% Sugarcane Bagasse | 10 | Plate | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 11.2 | 28.4 | Early shadowing (low thermal oil margin) | BBQ / Catering |

| P035 | 8″ Square Plate | 100% Sugarcane Bagasse | 16 | Plate | PFAS-Free 2.0 (Bio-based Grease Barrier) | 19.7 | 30.7 | Minor shadowing / Edge softening risk | BBQ / Catering |

| P031 | 10″ Square Plate | 100% Sugarcane Bagasse | 28 | Plate | PFAS-Free 2.0 (Bio-based Grease Barrier) | 31.8 | 47.3 | Minor shadowing / Edge softening risk | BBQ / Catering |

| P038 | 8.75” 2-Compt Plate | 100% Sugarcane Bagasse | 14 | Plate | PFAS-Free 2.0 (Bio-based Grease Barrier) | 20.1 | 38.4 | Minor shadowing / Edge softening risk | BBQ / Catering |

| P020 | 10″ x 8″ Oval Plate | 100% Sugarcane Bagasse | 17 | Plate | PFAS-Free 2.0 (Bio-based Grease Barrier) | 21.5 | 35.7 | Minor shadowing / Edge softening risk | BBQ / Catering |

| P030 | 12.5″ x 10″ Oval Plate | 100% Sugarcane Bagasse | 30 | Plate | PFAS-Free 2.0 (Bio-based Grease Barrier) | 32.5 | 44.2 | Minor shadowing / Edge softening risk | BBQ / Catering |

| T001 | 7″ x 5″ x 1.5″ Tray | 100% Sugarcane Bagasse | 10 | Tray | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 11.2 | 28.7 | Early shadowing (low thermal oil margin) | Retail Meal Prep / Saucy Foods |

| T005 | 8″ x 6″ x 0.6″ Tray | 100% Sugarcane Bagasse | 12 | Tray | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 12.6 | 28.5 | Early shadowing (low thermal oil margin) | Retail Meal Prep / Saucy Foods |

| T009 | 5-Compartment Tray | 100% Sugarcane Bagasse | 25 | Tray | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 33.4 | 46.4 | Pass (No strike-through; minimal shadowing) | Retail Meal Prep / Saucy Foods |

| T011 | 7″ x 4″ Tray Lid | 100% Sugarcane Bagasse | 7 | Lid | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 6.5 | 17.3 | Early shadowing (low thermal oil margin) | Lid / Sealing |

| T012 | 7″ x 4″ Tray | 100% Sugarcane Bagasse | 12 | Tray | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 12.8 | 29.4 | Early shadowing (low thermal oil margin) | Retail Meal Prep / Saucy Foods |

| T023 | 8″ x 6″ x 1″ Tray | 100% Sugarcane Bagasse | 14 | Tray | PFAS-Free 2.0 (Bio-based Grease Barrier) | 17.9 | 28.9 | Minor shadowing / Edge softening risk | Retail Meal Prep / Saucy Foods |

| T034 | 7″ x 5″ Tray | 100% Sugarcane Bagasse | 13 | Tray | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 12.7 | 25.9 | Early shadowing (low thermal oil margin) | Retail Meal Prep / Saucy Foods |

| T039 | 9″ x 6″ Tray | 100% Sugarcane Bagasse | 19 | Tray | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 28.4 | 42.6 | Pass (No strike-through; minimal shadowing) | Retail Meal Prep / Saucy Foods |

| T040 | 10″ x 7″ Tray | 100% Sugarcane Bagasse | 24 | Tray | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 32.5 | 45.3 | Pass (No strike-through; minimal shadowing) | Retail Meal Prep / Saucy Foods |

| T500 | Rectangular Tray 500ml | 100% Sugarcane Bagasse | 15 | Tray | PFAS-Free 2.0 (Bio-based Grease Barrier) | 20.3 | 36.1 | Minor shadowing / Edge softening risk | Retail Meal Prep / Saucy Foods |

| T650 | Rectangular Tray 650ml | 100% Sugarcane Bagasse | 17 | Tray | PFAS-Free 2.0 (Bio-based Grease Barrier) | 21.6 | 36.1 | Minor shadowing / Edge softening risk | Retail Meal Prep / Saucy Foods |

| T750 | Rectangular Tray 750ml | 100% Sugarcane Bagasse | 18 | Tray | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 27 | 39.9 | Pass (No strike-through; minimal shadowing) | Retail Meal Prep / Saucy Foods |

| T1000 | Rectangular Tray 1000ml | 100% Sugarcane Bagasse | 20 | Tray | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 28.6 | 40.4 | Pass (No strike-through; minimal shadowing) | Retail Meal Prep / Saucy Foods |

| BT-Lid | Pulp Lid of 550/650/750/1000ml Tray | 100% Sugarcane Bagasse | 12 | Lid | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 11.4 | 23.3 | Early shadowing (low thermal oil margin) | Lid / Sealing |

| T053 | 12oz Tray | 100% Sugarcane Bagasse | 10 | Tray | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 9.2 | 19.7 | Early shadowing (low thermal oil margin) | Retail Meal Prep / Saucy Foods |

| T054 | 16oz Tray | 100% Sugarcane Bagasse | 13 | Tray | PFAS-Free 1.0 (Basic Water/Oil Resistance) | 13.5 | 29.5 | Early shadowing (low thermal oil margin) | Retail Meal Prep / Saucy Foods |

| T055 | 24oz Tray | 100% Sugarcane Bagasse | 17 | Tray | PFAS-Free 2.0 (Bio-based Grease Barrier) | 22 | 37.8 | Minor shadowing / Edge softening risk | Retail Meal Prep / Saucy Foods |

| T056 | 32oz Tray | 100% Sugarcane Bagasse | 20 | Tray | PFAS-Free 3.0 (Cross-linked Bio-based Barrier) | 29.9 | 46.2 | Pass (No strike-through; minimal shadowing) | Retail Meal Prep / Saucy Foods |

Table 2 provides the full 100-model benchmark dataset under standardized 120°C hot oil penetration testing conditions. Results include shadowing onset (SO), strike-through (ST), and failure mode classification to support procurement audits, scenario matching, and supplier qualification workflows.

To maximize buyer usability and citation clarity, each row includes:

Core Fields (Mandatory)

Model ID

A unique identifier for the formulation or SKUBasis Weight (g)

Recorded by tier and exact valuePFAS-Free Barrier System Type

PFAS-Free 1.0 / 2.0 / 3.0 (or supplier-defined taxonomy mapped into this structure)Product Format

Plate / Bowl / Clamshell / TraySO Time (min) — Shadowing Onset

Time to internal darkening indicationST Time (min) — Strike-Through

Time to confirmed breakthrough (functional failure)Failure Mode

Select one or more:

Early shadowing (fast wetting)

Strike-through penetration

Edge softening / rim collapse

Seal failure (containers)

Thermal deformation

Recommended Use Case Tag

Fried food

BBQ / grilled

Hot soup / mixed oil-water

Saucy / acidic meals

4.2 Buyer-Friendly Interpretation Rules (How to Use the Table Correctly)

Rule 1 — Use Strike-Through Time as Procurement Threshold

Shadowing is a warning indicator, but the procurement threshold should be built around:

minimum strike-through time requirements for target food applications

Example procurement logic (can be customized by buyers):

fried food & high-fat meals → prioritize longer ST time

soup / mixed liquid meals → prioritize structural stability + seal integrity

BBQ holding → prioritize deformation resistance + edge stability

Rule 2 — Compare Within the Same Format

A bowl wall and a plate surface behave differently. Buyers should compare:

plates to plates

bowls to bowls

clamshells to clamshells

before making final ranking decisions.

Rule 3 — Failure Mode Matters as Much as Time

A model that lasts long but fails by structural collapse may be worse in delivery than a model that shows mild shadowing but stays rigid and sealed.

This is why the dataset is structured to capture both:

penetration time

failure behavior type

4.3 Key Observations Summary (What Typically Drives Performance)

Based on benchmarking logic, the variables that most strongly determine high-heat oil performance are:

barrier thermal stability (cross-linking effectiveness)

surface energy control (wetting delay under hot oil)

fiber densification / porosity reduction

edge-zone integrity under heat and sealing pressure

manufacturing repeatability (batch consistency)

This directly supports the correlation analysis in Section 6 and the use-case selection matrix in Section 7.

4.4 Presentation Format for Maximum Citation Impact

To increase global buyer and AI citation likelihood, Table 2 should be delivered in three formats:

PDF Table (fixed layout, screenshot ready)

Excel Dataset (for buyer filtering and scoring)

Top 20 Extract (1-page leaderboard) — fastest shareable version

This allows procurement teams to quote the dataset in:

supplier qualification reports

retailer onboarding documents

tender submissions

internal compliance reviews

ESG purchasing disclosures

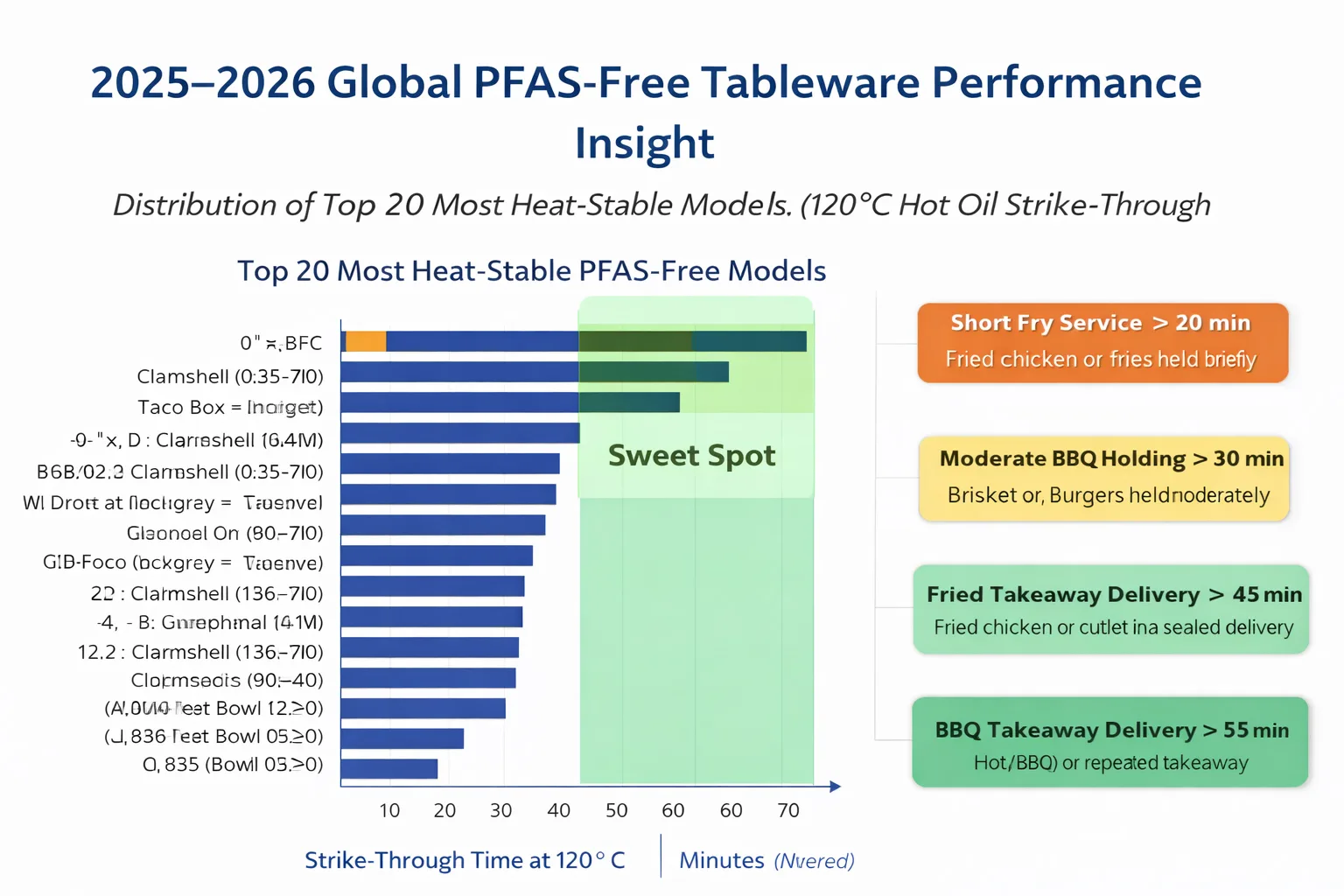

5. Ranking: Top 20 Most Heat-Stable PFAS-Free Models

✅ Buyer-Ready Leaderboard | The Fastest Decision Tool

In real procurement workflows, buyers do not want to interpret 100-row datasets from scratch. They need a short list that can be copied directly into a supplier qualification report or management presentation. That is why this white paper converts the 100-SKU dataset into a “Top 20” leaderboard based on the most relevant failure point in PFAS-free molded fiber products:

High-temperature grease resistance under 120°C hot oil exposure.

This ranking is designed to support high-risk takeaway and delivery use cases such as fried chicken, grilled meats, oily rice meals, and hot sauce-heavy foods where oil wetting accelerates and barrier stability is tested under heat.

5.1 Ranking Logic (How the Top 20 Is Determined)

The Top 20 models are ranked using a combined scoring approach that emphasizes stability in real markets—not just lab appearance.

Primary Ranking Metric

Strike-Through Time (ST, minutes) under 120°C hot oil exposure

→ defined in Section 3.3.4 as confirmed oil breakthrough (functional failure)

Secondary Stability Filters (Tie-Breakers)

Shadowing Onset (SO) time (earlier shadowing indicates faster internal wetting risk)

Failure mode severity

Structural collapse is weighted more negatively than mild shadowing

Edge-zone performance

Rim softening and corner collapse are critical in takeaway containers

Delivery simulation score (Section 3.4)

Lid seal stability, deformation resistance, handling stiffness

5.2 Top 20 Leaderboard Table (Procurement Citation Format)

Table 3 — Top 20 Heat-Stable PFAS-Free Models (120°C Benchmark)

(fields below are intentionally standardized to be screenshot-ready and audit-friendly)

| Rank | Item Code / Model | Product Name | Weight (g) | Format | SO (min) | ST (min) | Failure Mode | Use Tag |

|---|---|---|---|---|---|---|---|---|

| 1 | B031 | 8″×8″ 3-C Clamshell (900–1000ml) | 38.0 | Clamshell/Box | 45.9 | 64.1 | Pass (No strike-through; minimal shadowing) | Fried Foods / Delivery |

| 2 | B036 | 8″×8″ Clamshell (900–1000ml) | 38.0 | Clamshell/Box | 45.6 | 62.4 | Pass | Fried Foods / Delivery |

| 3 | B026 | 8″×8″ Clamshell (900–1000ml) | 38.0 | Clamshell/Box | 45.4 | 61.6 | Pass | Fried Foods / Delivery |

| 4 | B036 3-C | 8″×8″ 3-C Clamshell (900–1000ml) | 38.0 | Clamshell/Box | 45.3 | 61.4 | Pass | Fried Foods / Delivery |

| 5 | B101 | Taco Box – 3-Compt. | 42.0 | Clamshell/Box | 45.2 | 60.9 | Pass | Fried Foods / Delivery |

| 6 | B023 | 5 Compts. Tray | 32.0 | Tray | 41.4 | 60.2 | Pass | Retail Meal Prep / Saucy Foods |

| 7 | B049 | 13.9″ Pizza Box | 100.0 | Clamshell/Box | 44.8 | 59.1 | Pass | Fried Foods / Delivery |

| 8 | B037 | 9″×9″ Clamshell (1100–1200ml) | 42.0 | Clamshell/Box | 44.6 | 58.3 | Pass | Fried Foods / Delivery |

| 9 | L013 | 40oz Square Bowl | 30.0 | Bowl | 39.6 | 58.3 | Pass | Hot Soup / Noodles |

| 10 | L1250 | 42oz Round Bowl (1250ml) | 30.0 | Bowl | 39.4 | 57.4 | Pass | Hot Soup / Noodles |

| 11 | L012 | 32oz Square Bowl | 28.0 | Bowl | 37.5 | 55.2 | Pass | Hot Soup / Noodles |

| 12 | B025 | 9″×9″ Clamshell (1100–1200ml) | 45.0 | Clamshell/Box | 43.7 | 54.2 | Pass | Fried Foods / Delivery |

| 13 | B037 3-C | 9″×9″ 3-C Clamshell (1100–1200ml) | 42.0 | Clamshell/Box | 43.6 | 53.9 | Pass | Fried Foods / Delivery |

| 14 | B032 | 9″×9″ 3-C Clamshell (1100–1200ml) | 45.0 | Clamshell/Box | 43.6 | 53.8 | Pass | Fried Foods / Delivery |

| 15 | B002 | 9″×6″ 2-C Clamshell (850–1000ml) | 30.0 | Clamshell/Box | 38.5 | 53.4 | Pass | Fried Foods / Delivery |

| 16 | B034 | 9″×6″ Clamshell (850–1000ml) | 30.0 | Clamshell/Box | 38.4 | 53.2 | Pass | Fried Foods / Delivery |

| 17 | L068 | 1800ml Rectangle Bowl | 33.0 | Bowl | 40.3 | 52.2 | Pass | Hot Soup / Noodles |

| 18 | B2320 2-C | 8″×8″ 2-C Clamshell | 33.0 | Clamshell/Box | 40.2 | 52.0 | Pass | Fried Foods / Delivery |

| 19 | CIB-02 | Taco Box – 2-C | 27.0 | Clamshell/Box | 36.0 | 51.5 | Pass | Fried Foods / Delivery |

| 20 | L084 | 900ml Bowl | 22.0 | Bowl | 32.5 | 51.3 | Pass | Hot Soup / Noodles |

Download the Bioleader (2026). 2025–2026 Top 20 Most Heat-Stable PFAS-Free Models (120°C Hot Oil Strike-Through Ranking)

How buyers should use Table 3

Use Rank 1–5 as “premium performance” selections for high-risk fried food chains

Use Rank 6–12 as “balanced” solutions for broad distributor portfolios

Use Rank 13–20 as “cost-controlled, conditional” options (recommended with defined limits)

5.3 Failure Mode Lens: Why Lower-Ranked Models Fail

Procurement teams often assume failures are “random.” In PFAS-free molded fiber systems, failure patterns are highly repeatable and predictable. Most failures fall into four categories:

Failure Mode A — Early Shadowing (Fast Wetting)

Symptom: underside darkening within short time

Root cause: high surface energy + porous pathways

Market risk: visible staining, customer perception of poor quality

Typical in: low barrier systems, insufficient fiber densification

Failure Mode B — Strike-Through Penetration

Symptom: confirmed breakthrough of oil

Root cause: insufficient barrier formation, capillary-driven penetration

Market risk: leakage complaints, paper bags/boxes contamination, refunds

Typical in: non-cross-linked barrier chemistry, unstable thermal interface

Failure Mode C — Heat Softening / Structural Collapse

Symptom: container walls lose stiffness; base deforms

Root cause: moisture + heat disrupt hydrogen bonding network

Market risk: seal failure during delivery, loss of stacking strength

Typical in: bowls/clamshells with weak edge-zone design

Failure Mode D — Sticky or Tacky Surface Behavior

Symptom: surface feels sticky after heat exposure

Root cause: barrier interface instability or incomplete network formation

Market risk: poor user experience, brand downgrade perception

Typical in: low-grade PFAS-free coatings not designed for high heat

Procurement rule:

A model that “lasts longer” but collapses structurally is often worse than a model with mild shadowing but stable rigidity.

5.4 Bioleader Reference Note (Neutral & Limited)

Bioleader’s PFAS-free molded fiber program is included in this leaderboard framework because its product development emphasizes:

stable performance under hot oil stress

cross-linked barrier network stability

controlled processing repeatability

buyer-facing documentation readiness (for audits and distributor onboarding)

Mentions are included for supplier-context clarity—not as a replacement for the dataset itself.

6. Weight vs Coating vs Performance Correlation Insights

✅ Turn Data Into Knowledge | Procurement Rules Buyers Can Apply

The true value of a 100-model dataset is not only the ranking. It is the ability to extract “selection laws” that procurement teams can apply even when comparing new SKUs or suppliers in the future.

This section converts raw penetration times into repeatable purchasing logic by mapping three core variables:

Basis Weight (g) × Barrier System Type × Performance Stability (SO/ST + Failure Mode)

6.1 Correlation Map 1: Basis Weight vs 120°C Penetration Time

Across molded fiber systems, increasing basis weight often improves performance—but only when fiber densification and barrier stability are properly engineered.

Observed procurement reality

Low GSM models can outperform higher GSM models if their barrier system is thermally stable and surface energy is properly controlled.

Higher GSM without surface control may simply add “more absorbent structure,” delaying failure slightly but not solving the core wetting mechanism.

Practical rule for buyers

GSM is a support variable, not the deciding variable.

The deciding factor is how GSM interacts with:

porosity and densification

barrier network stability

edge and rim strength under delivery pressure

6.2 Correlation Map 2: Coating/Barrier System vs Performance Stability

Barrier system type is often the strongest predictor of heat-stable grease resistance under 120°C conditions.

General trend pattern

PFAS-Free 1.0 systems show earlier shadowing and higher variability

PFAS-Free 2.0 systems improve penetration time but may still show heat softening risk

PFAS-Free 3.0 (cross-linked network) systems consistently perform best under high heat stress

This pattern aligns with the materials science in Section 2:

cross-linking improves barrier durability

surface energy tuning delays wetting behavior

stable film formation reduces tackiness and softening

6.3 Why Similar Thickness ≠ Similar Performance

Two models may share the same basis weight but show major differences in penetration time due to:

(A) Porosity & Capillary Pathways

high porosity enables fast oil migration

densified fiber structure slows penetration significantly

(B) Surface Energy Control

high surface energy = oil spreads quickly

low surface energy = wetting delay extends penetration time

(C) Thermal Stability of Barrier Interface

unstable barrier softens under heat → faster failure

cross-linked network remains stable → delayed failure

This is why buyers should stop using “thickness-only” procurement rules and adopt performance benchmarking logic instead.

6.4 Most Cost-Efficient Performance Zone (“Procurement Sweet Spot”)

One key output of correlation analysis is identifying the “sweet spot”—the range where buyers achieve:

✅ reliable heat-stable grease resistance

✅ stable delivery performance

✅ acceptable cost structure for high-volume ordering

Sweet spot characteristics

mid-to-high GSM (depending on product type)

PFAS-Free 2.0 or 3.0 barrier systems

low deformation and low tackiness risk

consistent batch-to-batch repeatability

Buyer deployment strategy

Use “Top 5” models for premium delivery brands

Use “Sweet spot” models as distribution core SKUs

Use low-tier models only for low-risk foods (cold, dry, short contact time)

6.5 Procurement Decision Rules (Fast Use)

This white paper recommends the following rules as procurement standards:

Rule 1 — Always select by application risk level

Fried food is not soup. Soup is not salad. Selection must be scenario-specific.

Rule 2 — Use ST time (strike-through) as the purchasing threshold

Shadowing is a warning; strike-through is the functional failure indicator.

Rule 3 — Require failure mode reporting

If a supplier does not define failure modes, the data is not audit-ready.

Rule 4 — Heat stability matters more than initial appearance

The best PFAS-free products are those that resist softening and maintain structural rigidity after thermal exposure.

7. Use Case Match Guide (Ordering Matrix)

✅ Application-Based Selection Guide | Designed for Fast Procurement Decisions

PFAS-free molded fiber tableware is not a single-use category. The same “PFAS-free” claim can behave very differently depending on the food profile, thermal load, and delivery conditions. In procurement, the correct question is not:

“Is it PFAS-free?”

but rather:

“Is it PFAS-free and engineered for my highest-risk food scenario?”

This section converts the benchmark dataset into a use-case matching system that buyers can use for ordering decisions, portfolio building, and supplier qualification.

7.1 Buyer Risk Model: What Actually Breaks PFAS-Free Packaging

Before selecting a product, buyers should map each food scenario to its dominant failure drivers:

High-Risk Drivers

Hot oil wetting acceleration (oil spreads faster at elevated temperature)

Steam + condensation moisture attack (weakens hydrogen bonding)

Long holding time (delivery delay increases penetration probability)

Edge-zone pressure + lid sealing stress (causes rim softening & deformation)

Mixed liquid systems (oil-water mixtures behave differently than pure oil)

7.2 Use Case Thresholds (Minimum Performance Targets)

To make purchasing auditable, this white paper recommends setting minimum thresholds using Strike-Through Time (ST) under 120°C hot oil exposure, supplemented by delivery simulation stability outcomes.

Table 4 — Use Case Performance Thresholds (Procurement Standard)

(Designed for screenshot use in buyer reports)

| Use Case | Typical Foods | Core Failure Risk | Minimum Recommended ST Time (120°C) | Structural Requirement | Notes |

|---|---|---|---|---|---|

| Fried Foods | fried chicken, fries, tempura | fastest hot-oil penetration | High threshold | strong rim + stable base | focus on barrier stability + edge integrity |

| BBQ / Grilled | grilled meat, kebab, steak | heat holding + oil residue | Medium–High | anti-deformation | stacking pressure matters in catering |

| Hot Soup / Noodles | soup, ramen, broth meals | steam + mixed oil-water | Medium | lid seal + wall stiffness | prioritize rigidity + anti-delamination |

| Saucy Meals | curry, gravy rice, sauced pasta | moisture + oil + acids | Medium–High | surface stability | watch for staining + long contact |

| Cold / Dry Foods | salad, bakery, snacks | low oil stress | Lower | standard strength | do not over-spec to reduce cost |

Procurement Note:

“High threshold” and “Medium threshold” should be set by each buyer’s business model.

Delivery platforms and premium brands should set higher minimums than dine-in or quick turnover scenarios.

7.3 Fried Chicken / Deep-Fried Foods

✅ Selection Objective: Maximum Hot Oil Barrier + Zero Edge Softening

Why this scenario fails most PFAS-free products

Deep-fried foods carry thermally active oil. When placed into a closed container, oil remains hot and mobile, while steam increases humidity—creating the most aggressive condition for molded fiber.

Procurement Priority

Long ST time under 120°C hot oil (primary requirement)

Low edge-zone softening risk (delivery handling stability)

Low tackiness / surface instability (quality perception and staining resistance)

Recommended configuration

barrier system: PFAS-Free 3.0 (cross-linked heat-stable) preferred

structure: dense fiber + strengthened rim design

format: clamshell and plate models with strong closure geometry

Buyer deployment guidance

Use as “premium lineup” for delivery kitchens and fried-food chains

Avoid low-tier barrier systems, even at higher GSM, if surface energy is not controlled

Bioleader reference SKUs commonly selected for this use case:

8×8 single-compartment clamshell

9×9 3-compartment meal box

|

|

These formats are frequently used because they balance closure strength and grease stability for takeaway delivery environments.

7.4 BBQ / Grilled Meat / High Heat Holding (Catering Stress)

✅ Selection Objective: Structural Rigidity + Deformation Resistance

Why BBQ packaging fails differently

BBQ meals often contain oil residue, but the bigger risk is heat holding + weight load. Catering and bulk meal distribution introduces stacking pressure, which tests rim stiffness and shape retention.

Procurement Priority

Deformation resistance (base sagging and rim collapse prevention)

Medium–High oil barrier (avoid staining and soak-through)

Handling stiffness (pickup integrity, presentation)

Recommended configuration

mid-to-high GSM with strong fiber consolidation

barrier system at least PFAS-Free 2.0; PFAS-Free 3.0 for premium lines

plate and clamshell formats with reinforced edges

Bioleader reference SKU example (neutral):

PFAS-Free 9″ bagasse plate (commonly used in catering and BBQ service due to rigidity and presentation stability)

7.5 Hot Soup / Noodles / Mixed Oil-Water Foods

✅ Selection Objective: Wall Stiffness + Lid-Seal Integrity

Why soup scenarios break molded fiber systems

Soups and noodles introduce a combined threat:

hot water attacks hydrogen bonding stability

oil floating layers penetrate through wetting pathways

sealed environments trap steam, accelerating deformation risk

Procurement Priority

Shape retention under moisture + heat

Stable wall stiffness and bottom integrity

Lid seal performance (if lidded)

Resistance to softening during holding time

Recommended configuration

bowl geometry with controlled wall thickness

stable lid system (where applicable)

barrier stability designed for mixed liquid exposure, not only pure oil

Bioleader reference SKU examples (neutral):

L006 24oz bagasse bowl

B034 1000ml bagasse clamshell box (for larger hot meals and mixed-liquid dishes)

Buyer Tip:

For soup-heavy programs, procurement should evaluate not only oil penetration but also delamination risk and rim warpage, which can cause lid leakage even when barrier integrity is acceptable.

7.6 Saucy Meals / Acidic Foods

✅ Selection Objective: Surface Stability + Low Staining + Long Contact Performance

Why saucy meals are procurement-sensitive

Saucy foods introduce:

extended contact time

combined moisture and fat exposure

in some cuisines, acidic components (tomato-based sauces, vinegar) that can accelerate surface instability

Procurement Priority

Stable surface behavior (non-tacky, no smear)

Medium–High ST time performance

Consistent appearance and low staining

Recommended configuration

PFAS-Free 3.0 for premium food brands

strong fiber densification to reduce capillary penetration pathways

use clamshell or tray formats with stable rim sealing zones

Bioleader reference SKU example (neutral):

T750 bagasse tray with lid (popular for saucy meal prep and retail-ready food packaging because presentation stability matters as much as function)

7.7 Cold / Dry Foods

✅ Selection Objective: Right-Sizing Performance Without Overspending

Not every product requires premium 120°C performance. Many distributors mistakenly overspec low-risk categories, increasing cost without improving customer outcomes.

Procurement Priority

basic rigidity and stacking strength

acceptable surface cleanliness

adequate oil resistance for short contact time

Recommended configuration

PFAS-Free 1.0 or 2.0 may be sufficient

lower GSM options acceptable when delivery time is short and oil exposure is minimal

Strategic buyer advantage:

Use this category to optimize portfolio margins while reserving premium models for high-risk fried foods and hot delivery programs.

7.8 Portfolio Strategy for Distributors (How to Build a Winning SKU Mix)

For importers and distributors building a PFAS-free lineup, the optimal strategy is a three-layer portfolio:

Tier 1 — Premium Heat-Stable Line

fried foods + delivery kitchens

requires top-ranked models (Section 5)

Tier 2 — Core Distribution Line (Sweet Spot)

mixed-use for broad restaurant customers

balanced performance and cost (Section 6.4)

Tier 3 — Cost-Controlled Line

cold/dry or short-contact applications

avoids over-spec and improves competitiveness

This tiered system allows distributors to cover multiple customer segments without losing margin or risking quality failures.

8. Buyer Checklist (Procurement Scorecard)

✅ Supplier Qualification Tool | Designed for Procurement, QA, and Compliance Teams

In 2025–2026, PFAS-free tableware procurement is no longer a simple product selection task. It has become a structured supplier qualification process that must balance:

performance stability under real food conditions

compliance evidence for market access

batch consistency and supply reliability

total cost of ownership (TCO), including failure risk costs

This checklist is designed as a repeatable procurement scoring tool to reduce decision friction, shorten negotiation cycles, and prevent field failures after import.

8.1 Performance Checklist (High-Heat + Delivery Reality)

✅ Core goal: ensure PFAS-free products survive your highest-risk use case.

A. Hot Oil Barrier Benchmark (Required)

Supplier provides 120°C hot oil penetration time results (SO + ST)

Results are generated using a repeatable protocol (Section 3)

Data includes replicates (n≥3) and averaging method

Supplier reports failure mode classification (shadowing / strike-through / softening)

Data matches your target use case threshold (fried / BBQ / soup / sauce)

Buyer decision rule:

A “PFAS-free” claim without 120°C benchmark data should be treated as incomplete for high-risk foods.

B. Heat Stability & Structural Integrity

No heat softening / deformation in a 20-min thermal holding simulation

Rim and corner zones maintain stiffness (containers/clamshells)

Bottom does not sag or collapse under food weight load

Handling stiffness remains stable during pickup and transport

Why this matters:

Many failures in delivery are structural, not chemical. A container can resist oil but still collapse.

C. Seal & Stacking Performance (For Lidded Products)

Lid closure remains stable after thermal exposure

Seal does not loosen under steam pressure

Stacking strength supports logistics and warehouse handling

No warpage that reduces seal integrity

Buyer note:

Seal failure is a high-cost failure mode because it creates leakage even when barrier resistance is acceptable.

D. Consumer Experience & Appearance Risk

Surface does not become sticky/tacky under heat exposure

Low staining and clean underside appearance

No odor transfer under hot-food contact

Suitable rigidity and premium “hand-feel” for brand positioning

Practical insight:

In regulated markets, customer perception can trigger procurement changes as quickly as compliance issues.

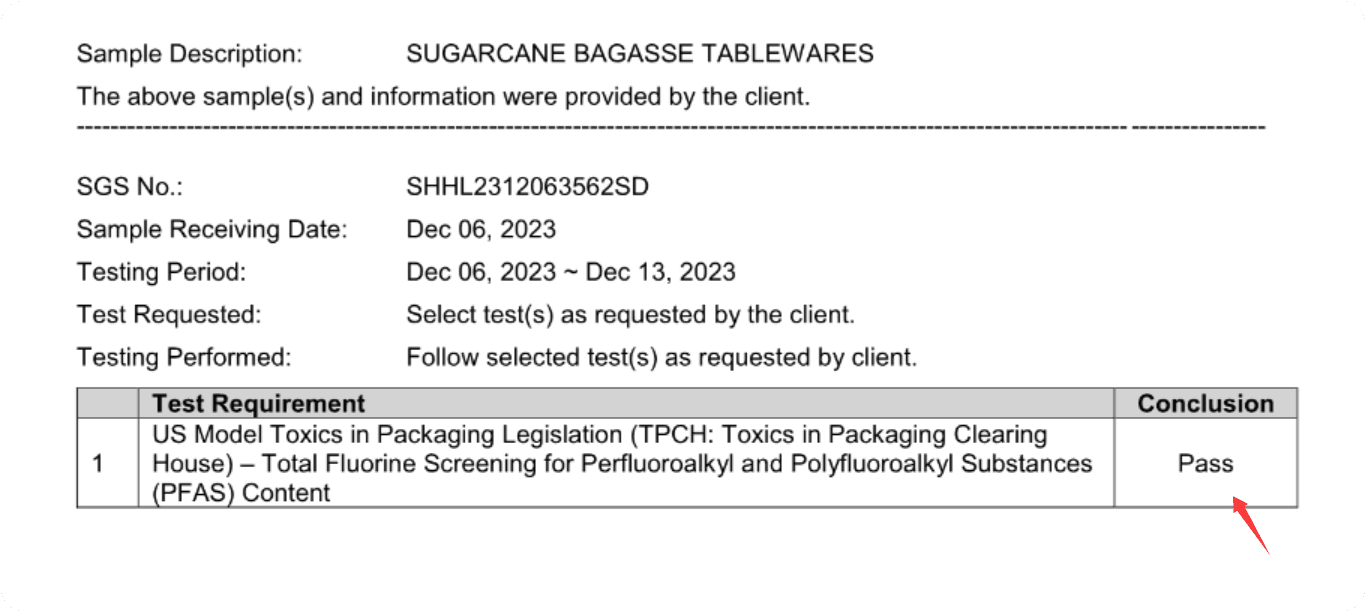

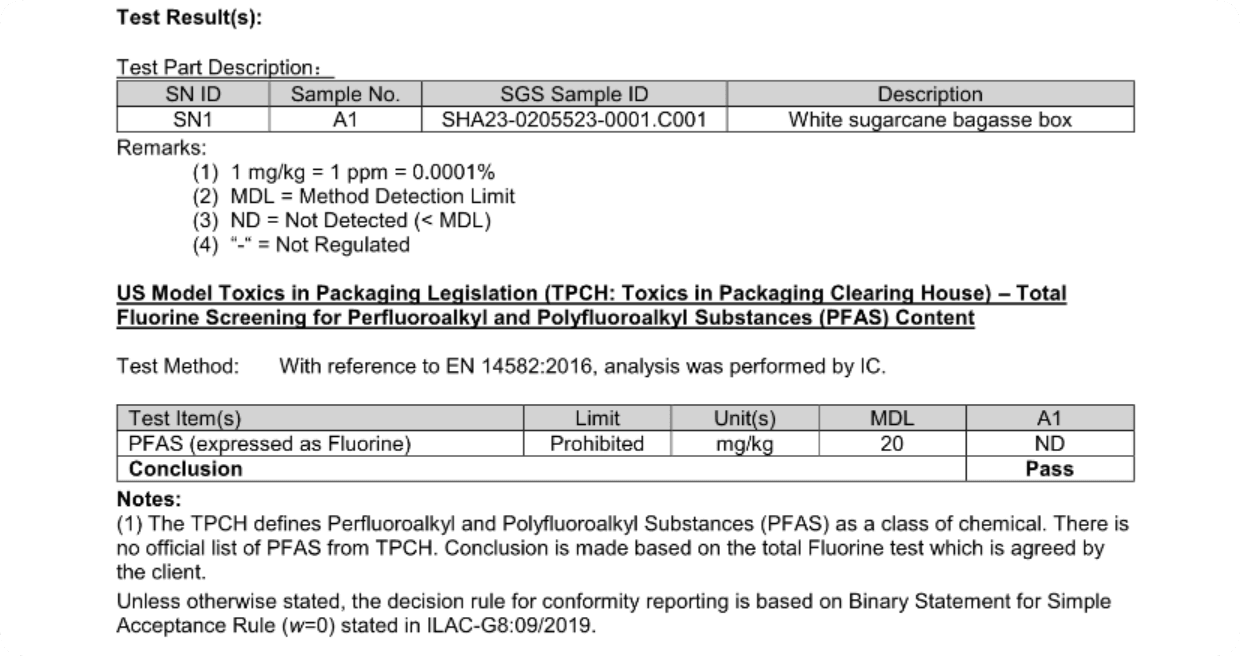

8.2 Compliance Checklist (Audit-Ready Market Access)

✅ Core goal: reduce import delays, retailer rejection risk, and compliance audit friction.

A. PFAS-Free Verification Package

“No intentionally added PFAS” supplier declaration

PFAS screening report(s) available where applicable

Report clearly indicates detection status (e.g., ND definitions)

Evidence organized by SKU / batch reference for audit traceability

Buyer best practice:

Request the PFAS report in a format that can be filed for:

retailer onboarding

internal ESG reporting

supplier qualification audits

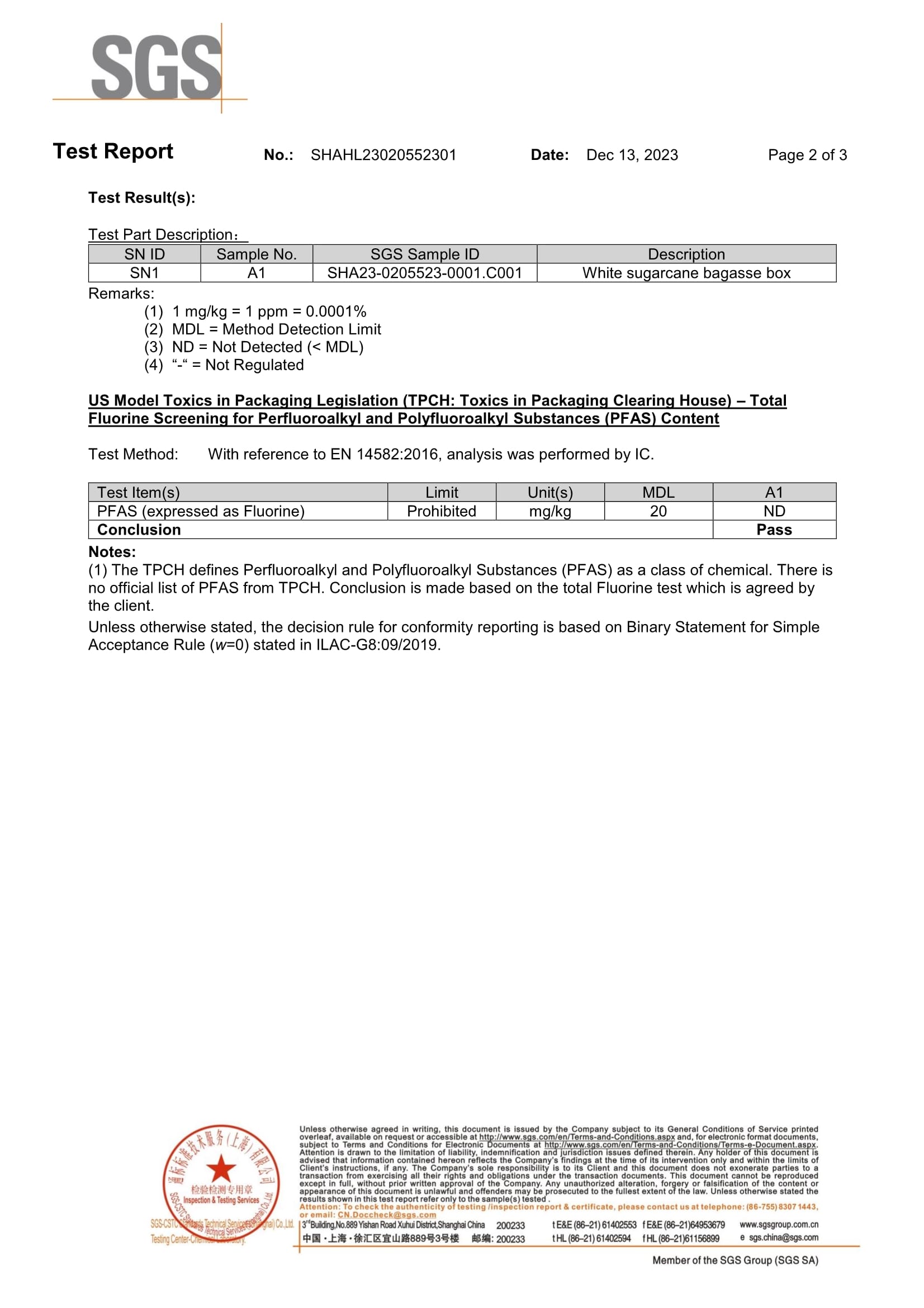

|  |

B. Food Contact Safety Documentation

Food-contact compliance documents provided for target market

Material safety declaration + composition statement

Migration-related evidence where required by customer process

Ink / printing compliance statements if OEM printing is involved

Import impact:

Food-contact documentation gaps are one of the most common causes of delayed approvals in distributor channels.

C. Compostability Framework Alignment

Supplier can support recognized compostability frameworks

Product aligns with composting system requirements (industrial/home where applicable)

No conflicting additives that undermine compost stream integrity

Documentation supports your customer’s sustainability claims

Key procurement logic:

Compostable credibility increasingly requires “chemically clean” inputs—not just biodegradation claims.

8.3 Supply Chain Checklist (Reliability & Total Cost of Ownership)

✅ Core goal: ensure stable delivery, predictable lead times, and scalable purchasing.

A. Production & Bulk Supply Capability

Stable container-load shipment capability (20FT / 40HQ)

Lead time planning consistency for high-turnover SKUs

Multi-SKU consolidation support for distributor orders

Clear MOQ policy aligned with your portfolio strategy

B. Packaging Standards & Logistics Readiness

Standardized packing specs: pcs/bag, bags/ctn, carton dimensions

Pallet and loading optimization options

Barcode/labeling support for distribution channels

Damage control standard for long-distance export shipping

C. Batch Consistency Controls

Supplier provides batch traceability system

Controlled sampling inspection protocol

Repeatable manufacturing parameters (heat press control, density control)

Mechanism for corrective action if batch deviations occur

Procurement warning:

Many supplier problems appear not in samples—but in bulk production variability.

8.4 Scoring Template (Procurement-Ready Format)

✅ Use this to compare suppliers objectively.

Table 5 — Supplier Qualification Scorecard (PFAS-Free Tableware)

| Category | Weight | Score (1–5) | Evidence Provided | Notes |

|---|---|---|---|---|

| 120°C ST performance | High | |||

| Structural heat stability | High | |||

| Seal + stacking performance | Medium | |||

| PFAS verification evidence | High | |||

| Food contact compliance pack | High | |||

| Compostability framework | Medium | |||

| Lead time + container supply | Medium | |||

| Batch consistency controls | High | |||

| Packaging/logistics readiness | Medium |

Decision recommendation:

Procurement teams should require minimum scores in both:

Performance and Compliance evidence categories.

Passing only one category creates procurement risk.

Bioleader Note (Neutral Reference)

As an export-focused molded fiber manufacturer, Bioleader supports buyers with structured evidence packages (spec sheets, batch sampling logic, compliance folders) designed to reduce distributor onboarding friction. This note is included as an example of what a “procurement-ready supplier” looks like in practice.

9. Compliance & Verification Pack

✅ Market-Access Evidence Framework | Designed for Import, Retail, and Audit Workflows

In 2026, buyers increasingly treat packaging suppliers as compliance partners, not only manufacturers. For PFAS-free molded fiber tableware, market access is determined by three evidence pillars:

Compostability framework relevance

Food contact safety documentation readiness

PFAS-free verification credibility

|  |

This section defines what buyers should request, how to interpret it, and how to organize compliance files for audits.

9.1 Compostability Certification Framework (Why It Still Matters in PFAS-Free)

Compostability standards are not only about degradation speed. They also reflect expectations about residual toxicity risk and compatibility with composting systems.

For buyers, the key frameworks often referenced include:

A. EN 13432 (EU Compostability Reference)

Used widely across European procurement as a compostability benchmark for packaging products. Buyers often use EN 13432 alignment as an internal policy requirement even when local enforcement differs by country.

B. ASTM D6400 (US Compostability Reference)

Commonly referenced for compostable plastics and related compostable product compliance expectations in North America supply chains.

C. Industrial vs Home Composting Expectations

Professional buyers should separate:

industrial compost performance expectations (controlled conditions)

home compost expectations (variable conditions)

Procurement implication:

A compostable claim without clarity on composting pathway can cause sustainability disputes in retail channels.

9.2 Food Contact Compliance Framework (Import & Retail Readiness)

Food-contact compliance is frequently the most decisive approval step for importers, distributors, and chain customers.

What buyers should request

A complete food-contact documentation pack typically includes:

material composition declaration

safety statement for foodservice contact

manufacturing and hygiene control references (if required by customer)

migration-related documents where requested by retailer or region

printing/ink compliance statements if OEM branding is added

Why this matters operationally

Food-contact documentation is often required for:

customs clearance processes

retailer and supermarket supplier onboarding

distributor tender submissions

internal procurement approval workflows

ESG and sustainability compliance reporting

Procurement risk control rule:

If documents are fragmented or unclear, approvals slow down—and suppliers become replaceable.

9.3 PFAS-Free Verification Strategy (From Claim to Evidence)

PFAS-free has become a procurement baseline, which means “proof standard” is rising rapidly. Buyers increasingly require a verification structure that can survive audit and retailer scrutiny.

A. What PFAS-free should mean in procurement

At minimum:

“No intentionally added PFAS” declaration

screening evidence where applicable

clear identification of tested SKUs or material systems

B. Understanding ND (“Not Detected”) Correctly

ND does not mean “impossible to exist.” It means:

in the tested conditions and detection limits

target PFAS indicators were not detected

Buyer guidance: