Quick Summary:

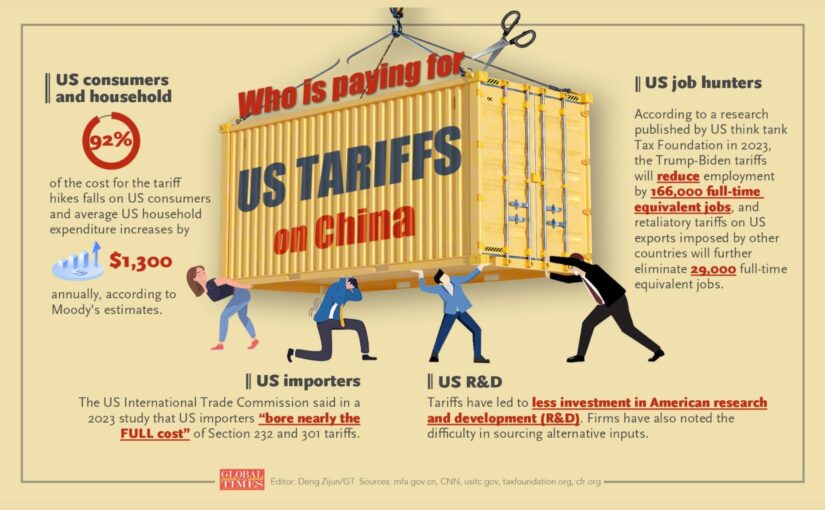

Challenge: In January 2026, the USITC finalized a 500% tariff ruling on Chinese thermoformed molded fiber products (HS Code 4823.70), effectively increasing the landed cost of sugarcane pulp and bamboo containers.

Strategy: Bioleader offers three strategic pathways: relocating production to Thailand to bypass AD/CVD tariffs, transitioning to corn starch containers (outside the tariff scope), and adopting tiered paper solutions (PE, PLA, and water-based coatings).

The Bottom Line: Compliance is your new competitive advantage. Ensuring “audit-ready” traceability and avoiding transshipment risks are essential to navigating this trade storm.

I. Industry Background: The Final Verdict on Thermoformed Molded Fiber Products

1.1 The January 2026 Trade Turning Point

In January 2026, the U.S. trade landscape for eco-friendly packaging shifted permanently. The U.S. International Trade Commission (USITC) issued its final determination on Thermoformed Molded Fiber Products from China. This ruling isn’t just a hurdle; it’s a barrier. By formalizing Anti-Dumping (AD) and Countervailing Duty (CVD) orders, the U.S. has effectively locked out traditional Chinese molded fiber imports with a “tax wall” designed to protect domestic production.

The U.S. government imposed this ruling after determining that Chinese manufacturers were dumping molded fiber products (made from various plant fibers, including sugarcane pulp, bamboo, wood pulp, etc.) at unfairly low prices and receiving subsidies from the Chinese government. This ruling aims to protect domestic U.S. producers from these trade practices. As a result, U.S. importers will face punitive tariffs that drastically increase the cost of importing these eco-friendly alternatives.

1.2 The “500% Math”: Why Profit Margins Are Vanishing

The current AD/CVD combination is catastrophic. With Anti-Dumping duties hovering near 470% and Countervailing duties adding upwards of 30%, the cumulative impact exceeds 500%.

The Reality: A shipment previously valued at $50,000 now carries a tariff liability of $250,000. For most U.S. importers, this isn’t just a price hike—it’s a business model terminator.

This increase in tariffs isn’t just a simple price rise—it’s a serious threat to business operations. Importers must take immediate action to adjust their supply chains and product offerings to avoid this financial burden.

1.3 Scope of Investigation: Identifying High-Risk Thermoformed Molded Fiber Products (HS Code 4823.70)

The duties apply to all Thermoformed Molded Fiber products, regardless of whether the raw material is sugarcane, bamboo, or wood pulp. These products are subject to AD/CVD tariffs due to the “molding” process, which involves pressing plant fibers into molded shapes through heat and pressure.

High-risk products identified under HS Code 4823.70 include:

Plates

Bowls

Lids

Hinged Containers (Clamshells)

Trays

Cup Holders

Products not included in this investigation:

Injection Molded Products, such as corn starch-based tableware, which are made using a different molding process and are not subject to these tariffs.

Paper-based Containers, such as paper bowls and boxes, which are formed from sheets of paper and folded or glued, rather than molded, and thus are not part of the “molding” process.

By clearly distinguishing which products are within the scope of the investigation and which are not, it’s easy to see how Bioleader’s alternative solutions can help U.S. importers avoid this tariff shock.

2. Solution 1: Supply Chain Relocation — Bioleader’s Thailand Partnership

2.1 Origin Strategy: Leveraging Thailand’s Mature Sugarcane Resources to Bypass the AD/CVD Barrier

In response to the 500% tariffs, shifting the manufacturing base to Thailand presents a strategic solution for U.S. importers. Bioleader’s Thailand facility, which leverages the country’s abundant sugarcane resources, enables the production of eco-friendly molded pulp products without triggering the U.S. anti-dumping (AD) and countervailing duty (CVD) tariffs.

Thailand’s sugarcane pulp production industry is well-established, with an extensive network of suppliers and efficient processing capabilities. By relocating production to Thailand, Bioleader ensures that the products are fully compliant with U.S. Customs regulations, specifically avoiding the “China Origin” designation under U.S. tariff rules.

2.2 Full-Scale Production: Real, Substantial Transformation in Thailand

One of the key requirements for bypassing the high tariffs is substantial transformation. U.S. Customs and Border Protection (CBP) mandates that goods imported from third countries must undergo meaningful manufacturing changes to avoid being treated as “Chinese origin.”

Bioleader’s Thailand facility performs all necessary steps of production, from sourcing raw sugarcane pulp to manufacturing finished molded pulp products. This transformation process goes beyond simple reprocessing or repackaging—our products undergo substantial manufacturing steps in Thailand, ensuring compliance with U.S. import laws.

|  |

By producing in Thailand, Bioleader can confidently provide the necessary documentation to prove the goods’ origin and manufacturing processes. This ensures that U.S. importers can clear customs without facing penalties or delays.

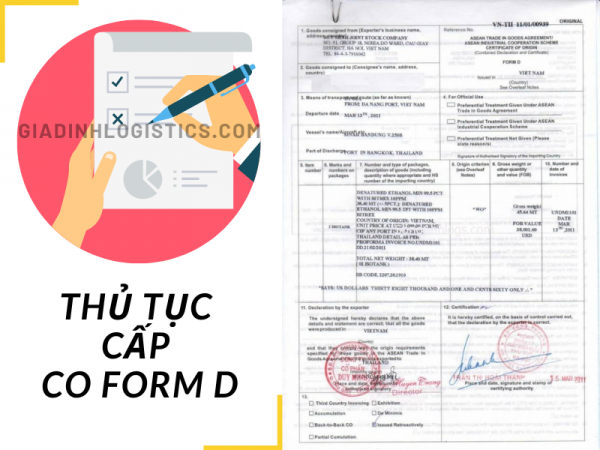

Bioleader Documentation Assurance:

Bioleader offers comprehensive traceability for products manufactured in Thailand, including:

Raw Material Invoices: Detailed documentation of the sugarcane pulp sourced from certified suppliers in Thailand.

Factory Energy and Production Records: Transparent records of energy consumption and manufacturing processes to prove the substantial transformation.

Certificates of Origin: Bioleader provides Form D or CO (Certificate of Origin) to verify the Thai origin of the products.

2.3 Logistics and Shipping: Seamless and Efficient Transport from Thailand

In addition to production, logistics and shipping efficiency are key to ensuring a smooth transition for importers. Shipping from Thailand to the U.S. is a well-established process, and Bioleader works with trusted logistics partners to ensure timely delivery.

Shipping Time to West Coast vs. East Coast: Average shipping times from Thailand to U.S. ports are typically 25-30 days to the West Coast and 35-40 days to the East Coast. These reliable routes allow U.S. importers to plan inventory effectively.

Strategic Warehouse Locations: Bioleader also partners with key logistics providers in the U.S. to offer flexible storage and distribution, ensuring that shipments arrive on time and are ready for efficient inventory management.

By using Bioleader’s Thailand base, U.S. importers can confidently plan for predictable lead times and efficient supply chain management, while avoiding the punitive tariffs associated with Chinese-origin molded fiber products.

3. Solution 2: Corn Starch-Based Containers — A High-Performance Physical Alternative

3.1 Injection Molding Advantages: Non-Molded Technology for Tax Code Compliance

Another strategic alternative to molded pulp products is corn starch-based containers, produced using injection molding technology (Non-Molded). Unlike molded pulp, which involves the pressing of plant fibers into a mold, corn starch-based containers are formed through a different process, making them eligible for a different tariff classification and completely bypassing the AD/CVD tariffs.

Injection molding is a highly flexible and cost-effective manufacturing process, allowing for a variety of shapes and sizes that meet the diverse needs of the foodservice market. By choosing corn starch-based containers, U.S. importers can comply with U.S. tariff laws and avoid the punitive tariffs on molded pulp products.

3.2 Performance and Cost: High Resistance for U.S. Foodservice Market

Corn starch-based containers offer excellent physical properties, including superior oil resistance, temperature tolerance, and structural strength, making them ideal for the U.S. foodservice market, particularly for high-oil and hot food applications.

Oil Resistance: Corn starch containers are particularly suitable for greasy or oily foods, such as fried items, where traditional paper-based or molded pulp containers might fail.

Temperature Resistance: These containers can withstand higher temperatures, which is crucial for takeout containers used in hot meal delivery.

Cost Effectiveness: Corn starch-based containers are not only a high-performance alternative to molded pulp, but they also offer cost savings due to the relatively low material cost and simplified manufacturing process compared to molded pulp products.

For U.S. importers, this balance of performance and cost makes corn starch containers an attractive alternative in a highly competitive market.

3.3 Degradable Value: Balancing Environmental Goals with Cost Efficiency

Corn starch-based products are also bio-based and compostable, aligning with growing consumer demand for sustainable packaging solutions. As consumers and businesses alike strive for more environmentally friendly options, corn starch containers offer a great balance between environmental benefits and cost-efficiency.

Corn starch-based containers can be composted in industrial composting facilities, reducing waste and contributing to a circular economy. They also meet key environmental certification standards, which helps businesses market their products as eco-friendly alternatives.

3.4 U.S. State-Level Plastic Bans Compatibility Analysis

Although corn starch-based containers excel in avoiding tariffs, it’s important to consider the impact of state-level plastic bans in regions like California, New York, and other areas with strict environmental policies.

California and New York: These states have comprehensive plastic bans that extend to various foodservice packaging materials. While corn starch-based containers do not contain plastic, importers must ensure that these containers are fully compliant with local regulations on biodegradability and compostability.

Local Compliance: Bioleader’s corn starch containers are fully compostable and align with most state-level regulations, making them a safer alternative in regions with stringent packaging laws.

However, importers should still verify local compliance in regions with strict environmental policies, as some areas may have specific requirements that must be met to ensure full acceptance of corn starch-based products.

3.5 Bioleader’s Corn Starch-Based Container Solutions

As a leading manufacturer of eco-friendly, biodegradable packaging, Bioleader offers a wide range of corn starch-based containers tailored for the foodservice industry. These products are designed to meet the growing demand for sustainable and cost-effective solutions that align with both environmental goals and budget constraints.

Bioleader’s cornstarch containers are certified compostable, ensuring that they meet the highest environmental and food safety standards. Whether you need takeout containers, trays, or bowls, Bioleader’s range offers reliable solutions that help your business stay ahead of the sustainability curve.

4. Solution 3: Paper Tableware (Paper Bowls/Boxes) — Tiered Coating Alternatives

4.1 PE Coated Paper: Cost-Effective Tax-Avoidance Solution for Traditional Markets

Polyethylene (PE) coated paper is a cost-effective alternative that remains a highly practical option for U.S. importers aiming to circumvent the AD/CVD tariffs while maintaining product affordability. PE-coated paper products, which include traditional paper bowls, plates, and food containers, provide a strong, moisture-resistant barrier, ensuring the product’s integrity in typical foodservice applications.

PE-coated paper is ideal for conventional markets where cost efficiency is a priority. Although not biodegradable, it offers a reliable solution for mainstream markets that may not have strict environmental mandates. Importers using PE-coated paper can save costs while avoiding punitive tariffs, though it is important to note that this solution is more suitable for non-premium, mass-market products.

4.2 PLA Coated Paper: 100% Biodegradable and Eco-Friendly Solution for Premium Markets

For businesses targeting the eco-conscious consumer, PLA-coated paper provides an alternative that aligns with sustainable practices. PLA (Polylactic Acid) is derived from renewable plant materials, making it 100% biodegradable and a more environmentally friendly option compared to PE-coated paper.

PLA-coated biodegradable paper bowls & containers are suitable for high-end markets that emphasize environmental sustainability and demand products that are fully compostable. These products comply with the growing consumer and legislative demand for eco-friendly alternatives in foodservice packaging, making them an excellent fit for businesses looking to align with green initiatives while avoiding high tariffs.

4.3 Water-Based Coating: The “Plastic-Free” Premium Solution Ahead of Plastic Bans

The water-based coating is the most advanced option in the sustainability category. Unlike PE or PLA, water-based coatings do not contain any plasticizers or synthetic chemicals, making them fully degradable and recyclable. These coatings are the most future-proof choice as they comply with upcoming plastic bans and environmental regulations.

Water-based coatings are ideal for businesses looking to stay ahead of global and U.S.-based plastic bans, especially in regions like California and New York, where stringent environmental regulations are already in place. These paper containers are the “ultimate green card”, allowing importers to confidently enter eco-friendly markets without the risk of product rejection due to non-compliance with the latest legislation.

4.4 U.S. State-Level Plastic Bans Compatibility Analysis

While PE-coated paper provides a cost-effective solution, it is not ideal for states with strict plastic bans like California or New York, where local regulations mandate the use of compostable or recyclable materials. Conversely, water-based coated paper containers are fully compliant with state-level plastic bans, as they do not contain harmful chemicals or non-biodegradable plastic.

These containers are recognized as fully compostable, biodegradable, and environmentally safe, making them a preferred choice for U.S. markets where plastic bans are either already in place or being phased in. Importers who rely on water-based coated products can enter high-demand, eco-conscious markets confidently, with the assurance that their products meet the most stringent environmental standards.

4.5 Bioleader’s Paper-Based Container Solutions

|  |

|  |

Bioleader is committed to providing sustainable packaging solutions that help businesses reduce their environmental impact while maintaining product quality and performance. Our paper-based containers, including those with PE, PLA, and water-based coatings, are compostable, biodegradable, and PFAS-free.

Our water-based coating technology ensures that Bioleader’s paper containers meet the most stringent plastic ban regulations in the U.S. and beyond. Whether you need cost-effective solutions or premium-grade, eco-friendly alternatives, Bioleader offers products that meet your needs and align with your sustainability goals.

5. Deep-Dive Warning: The “Transshipment” Red Line in Trade

5.1 CBP’s Zero-Tolerance Policy on Transshipment

One of the most pressing risks for U.S. importers is the transshipment of goods through third countries to evade tariffs. U.S. Customs and Border Protection (CBP) has zero tolerance for transshipment schemes, in which products are routed through countries like Thailand or Vietnam simply to alter the product’s origin and bypass tariffs. This practice is a direct violation of U.S. trade laws and could lead to severe penalties.

CBP has increasingly leveraged advanced data analytics and origin traceability technologies to track the movement of goods across borders. As a result, any attempt to evade tariffs through simple transshipment (e.g., changing packaging, relabeling) will be flagged and investigated, putting importers at significant legal and financial risk.

5.2 Key to Avoiding Risks: “Substantial Transformation” Concept

To ensure compliance, U.S. importers must understand the substantial transformation requirement. The substantial transformation test determines whether a product has undergone enough meaningful processing in a third country (like Thailand) to qualify as originating from that country.

For instance, simply relabelling, repacking, or changing packaging in a third country will not qualify as substantial transformation. Instead, the product must undergo a significant change in form, function, or appearance. Bioleader’s Thailand operation ensures that the entire manufacturing process, from raw material sourcing to finished product, occurs within Thailand, ensuring substantial transformation that meets U.S. Customs requirements.

5.3 Legal Risks: Consequences of Transshipment Violations

Transshipment violations can result in severe consequences, including:

Seizure and Forced Re-exportation: Products suspected of transshipment can be seized, and the importer may face forced re-exportation to the country of origin.

Inclusion on CBP’s Watch List: Importers found violating transshipment laws may be blacklisted by CBP, preventing them from importing goods into the U.S. in the future.

Fines and Penalties: The legal and financial ramifications can be severe, including fines and other penalties that significantly harm a company’s reputation and business operations.

Importers must ensure that their supply chain is compliant and fully documented to avoid these risks. Bioleader provides comprehensive documentation, including Form D and Certificates of Origin, to prove the legitimacy of the goods’ origin and ensure that they meet the standards required by CBP.

5.4 Traceability Assurance: Comprehensive Documentation to Support CBP Audits

To help U.S. importers comply with CBP’s strict guidelines, Bioleader provides a full traceability chain for all goods produced in Thailand:

Raw Material Invoices: Clear documentation of the sourcing of raw materials (e.g., sugarcane pulp) from verified Thai suppliers.

Energy and Production Records: Complete production logs detailing energy consumption and worker attendance to verify the manufacturing process.

Certificate of Origin: Bioleader can provide Form D or CO (Certificate of Origin) from Thai authorities, certifying that the products were manufactured in Thailand.

By providing these detailed and verifiable documents, Bioleader helps U.S. importers avoid penalties and navigate CBP audits with confidence.

6. Conclusion: Bioleader Helps You Navigate Trade Storms with Confidence

6.1 Professional Assurance: Bioleader’s Comprehensive Documentation

Bioleader offers full supply chain traceability, providing all the necessary documentation to ensure compliance with U.S. Customs regulations. This includes raw material certificates, production records, and origin certificates to support smooth customs clearance and avoid costly delays.

6.2 Environmental Assurance: All Solutions Are PFAS-Free

All of Bioleader’s products—molded pulp, corn starch, and paper-based containers—meet PFAS-free requirements, ensuring that customers comply with current and future U.S. state regulations on toxic chemicals in food packaging.

FAQ: Frequently Asked Questions

Q: How can I ensure that my imported products comply with the new 500% tariffs?

A: Bioleader offers full traceability for all products, including substantial transformation documentation and Certificates of Origin to ensure compliance with U.S. Customs regulations.

Q: Can Bioleader’s corn starch-based containers be used for both hot and cold food delivery?

A: Yes, Bioleader’s corn starch containers are designed to withstand high heat and oil resistance, making them ideal for various foodservice applications, including hot food delivery.

Q: What are the environmental benefits of using Bioleader’s paper-based containers?

A: Bioleader’s water-based coated paper containers are plastic-free, compostable, and biodegradable, making them fully compliant with the latest plastic bans and sustainable packaging standards.

Next Steps: Protect Your Margins and Stay Ahead

Navigating the 500% tariff wall may seem daunting, but with the right strategies, you can avoid the impact of these tariffs and future-proof your business. Bioleader provides a range of eco-friendly alternatives that meet both tariff and environmental challenges in the U.S. market.

Contact Bioleader for a tailored quote and consultation on your specific needs.

Request samples of our corn starch containers and paper-based solutions to evaluate their performance in your business.

Stay informed on future regulations and updates regarding tariffs and sustainable packaging solutions by subscribing to Bioleader’s newsletter.

By taking these proactive steps, you’ll be better equipped to navigate these changes while maintaining a strong competitive position in the U.S. foodservice market.

Reference

U.S. International Trade Commission (USITC). (2026). Final Determination on Thermoformed Molded Fiber Products from China. U.S. Government Publication.

World Trade Organization (WTO). (2024). Trade Remedies: Anti-Dumping and Countervailing Measures. WTO Annual Report.

U.S. Customs and Border Protection (CBP). (2025). Guidelines for Determining Substantial Transformation of Imported Goods. CBP Customs Handbook.

Environmental Protection Agency (EPA). (2023). PFAS-Free Packaging Regulations: Environmental Impacts and Compliance Standards. EPA Report.

Green Business Bureau. (2024). Sustainable Packaging Trends in the U.S. Foodservice Industry: Navigating Plastic Bans and Tariffs. Green Business Bureau Research.

U.S. Food and Drug Administration (FDA). (2025). Biodegradable and Compostable Packaging Materials: Regulations and Standards for Food Packaging. FDA Consumer Advisory.

International Trade Administration (ITA). (2023). Global Packaging Trade Barriers and Opportunities. U.S. Department of Commerce.

Institute of Packaging Professionals (IoPP). (2024). Innovations in Biodegradable Packaging for the Foodservice Industry. IoPP Annual Industry Report.