Why PFAS-Free Food Packaging Is Now a Business Imperative

PFAS (per- and polyfluoroalkyl substances), commonly referred to as “forever chemicals,” are synthetic compounds valued for their resistance to oil, grease, and water. They have been used extensively in food packaging—think microwave popcorn bags, burger wrappers, molded fiber salad bowls, and coffee cups.

However, the very properties that make PFAS useful also make them harmful. PFAS do not degrade in the environment and accumulate in human blood, wildlife, and water systems. The CDC’s NHANES survey showed that PFOA and PFOS levels in Americans’ blood decreased by over 70–85% between 1999 and 2019, following phase-outs, but newer PFAS substitutes remain in circulation.

Scientific studies link PFAS exposure to elevated cholesterol, reduced vaccine response, developmental delays, kidney and testicular cancer, and endocrine disruption. Regulators, retailers, and consumers are now demanding an end to PFAS in food packaging.

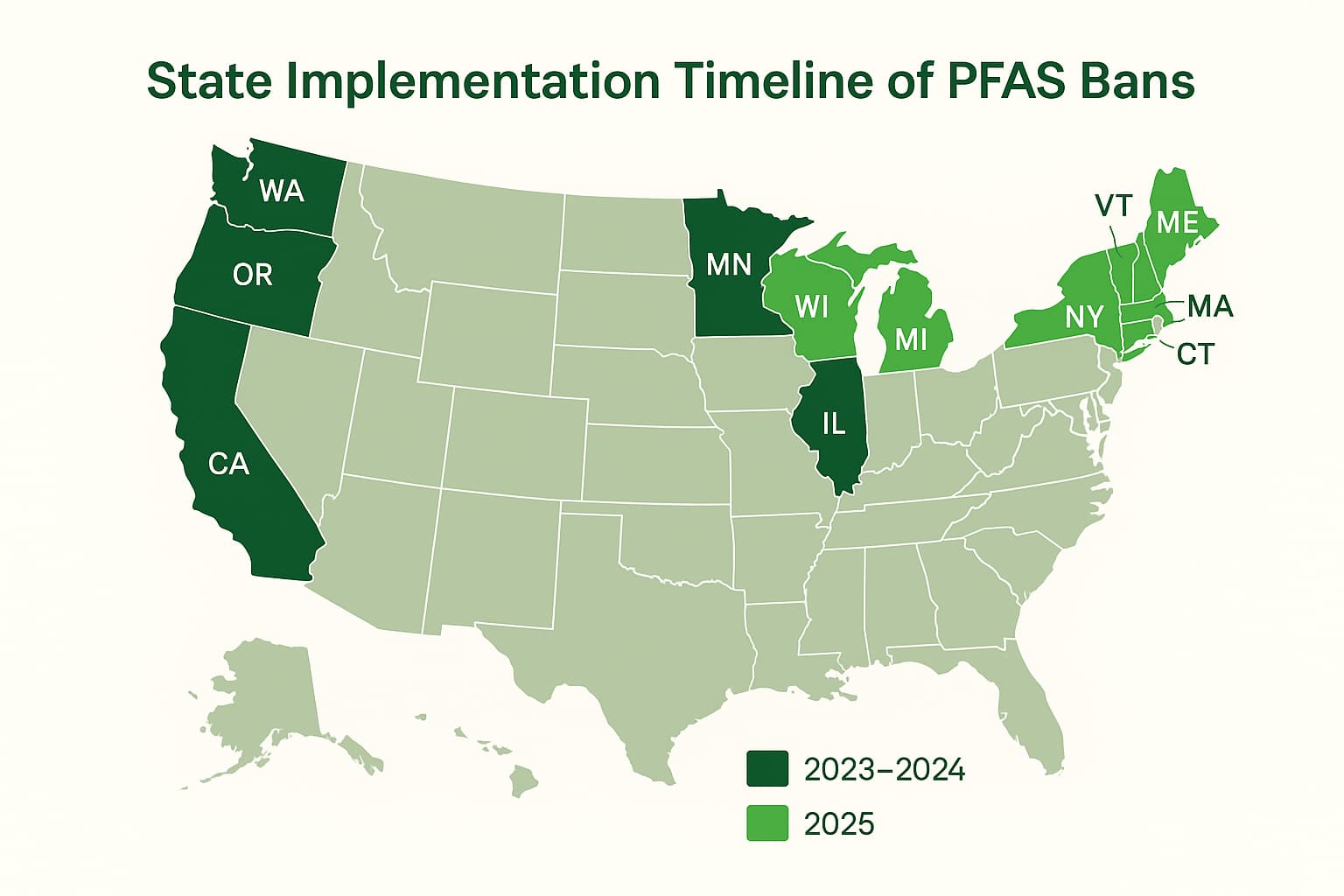

By 2025, multiple U.S. states—including Minnesota, Washington, Illinois, Oregon, and California—will enforce bans on PFAS-containing food packaging. Other states already have restrictions or proposals under review. For importers, brand owners, and packaging suppliers, compliance is no longer optional—it is a prerequisite for market access.

This comprehensive white paper maps the PFAS bans, examines compliance requirements, provides procurement recommendations, and highlights safe alternatives such as PFAS-free bagasse food containers for takeout, PLA cups with PFAS-free lining for beverages, compostable CPLA cutlery PFAS-free certified, and PFAS-free kraft paper bowls with lids.

State-by-State PFAS Bans: The Patchwork of Regulations

PFAS bans in the U.S. are not harmonized nationally. Instead, individual states set their own timelines and requirements. This creates a compliance mosaic that companies must navigate carefully.

States with Enforced or Upcoming Bans

New York (NY) – Ban effective Dec 2022, prohibits all food containers with intentionally added PFAS.

California (CA) – Phased bans began in 2023, extending through 2025; requires COC + labelling.

Vermont (VT) – Comprehensive ban effective July 2023.

Maine (ME) – Ban effective Jan 2023, also requires reporting of PFAS use.

Connecticut (CT) – Banned all intentionally added PFAS in packaging from 2023.

Colorado (CO) – Bans PFAS in packaging and certain consumer products effective 2024–2025.

Maryland (MD) – Restrictions phased in from 2024.

Minnesota (MN) – Full ban effective Jan 1, 2025; requires COC and supplier declarations.

Illinois (IL) – Ban effective Jan 1, 2025; requires labelling “PFAS-free.”

Washington (WA) – Progressive bans since 2018; by 2025, broad food-contact packaging must be PFAS-free.

Oregon (OR) – Ban effective Jan 1, 2025, covering foam cups and takeout packaging.

States with Pending or Proposed Bans

Massachusetts (MA), Michigan (MI), New Jersey (NJ), Pennsylvania (PA), Tennessee (TN), Iowa (IA) – Bills introduced to phase out PFAS-containing packaging from 2025 onward.

📊 Table 1: State-by-State PFAS Ban Overview

| State | Effective Date | Coverage Scope | Documents Required |

|---|---|---|---|

| New York | Dec 2022 | All food containers | COC + lab tests |

| California | 2023–2025 | Phased packaging bans | COC + label/QR |

| Vermont | 2023 | All food packaging | Supplier declarations |

| Maine | 2023 | Food packaging, reporting duty | Declarations + registry |

| Minnesota | Jan 2025 | All packaging | COC + supplier declarations |

| Illinois | Jan 2025 | Food containers | COC + labelling requirements |

| Washington | 2018–2025 | Paper-based food contact items | Safer alternatives compliance |

| Oregon | Jan 2025 | Foam cups & containers | Manufacturer compliance |

| Colorado | 2024–2025 | Packaging + consumer products | Declarations + COC |

| Maryland | 2024 | Food packaging restrictions | Supplier certification |

Market and Scientific Data: The Business Case for PFAS-Free

Consumer Reports Study (2022): Testing of 118 packaging items revealed 53% contained PFAS, with 30% exceeding 20 ppm organic fluorine.

ACS Environmental Science (2023): Identified 68 PFAS compounds in food packaging materials using targeted and untargeted analysis.

FDA (2024): Announced that grease-proofing PFAS used in food packaging are no longer sold in the U.S. market.

Minnesota Studies: Found PFAS in composting facility runoff and landfill leachates, highlighting environmental persistence.

Market Data (Grand View Research, 2024): Global PFAS-free packaging market expected to grow at CAGR 6.5% (2024–2030), reaching USD 25 billion by 2030.

Consumer Preferences: Nielsen surveys indicate 63% of U.S. consumers would pay more for food packaged in certified PFAS-free, sustainable materials.

Case Studies: Lessons from Real-World Transitions

McDonald’s & Starbucks

Both chains committed to eliminating PFAS from food packaging globally by 2025. Starbucks introduced PFAS-free hot cups in U.S. stores in 2023, using plant-based liners.

A Regional Supplier in Vermont

In 2023, a supplier lost contracts with local schools when PFAS was detected in its molded fiber trays. This underscores the risk of supply chain disruption for non-compliance.

Bioleader® Client Case

A U.S. importer needed PFAS-free packaging to enter the California market. Bioleader® supplied PFAS-free bagasse food containers for takeout and PFAS-free kraft paper bowls with lids, accompanied by COCs and lab test reports. The client secured contracts with a regional fast-casual restaurant chain, highlighting how PFAS-free certification is a market enabler.

Testing and Verification Methods

Compliance depends on reliable testing:

FTIR (Fourier-Transform Infrared Spectroscopy): Quick screening for PFAS indicators.

LC-MS/MS (Liquid Chromatography–Tandem Mass Spectrometry): Gold standard for quantification at ppb levels.

EPA Method 1633 (Draft): Multi-matrix method for 40 PFAS compounds.

Organic Fluorine Screening: Used as a broad indicator for PFAS presence.

Testing costs range from $500–$1500 per SKU, with turnaround times of 7–14 days. Importers should factor these into procurement planning.

Compliance Documents and Labelling Requirements

Certificate of Compliance (COC) – required in most states.

Lab Test Reports – mandatory in WA, CA, NY.

Supplier Declarations – raw material suppliers must confirm PFAS-free inputs.

Labelling – states like IL and CA mandate visible PFAS-free claims or QR code traceability.

📑 Table 2: Document Requirements by State

| State | COC | Lab Test | Supplier Declaration | PFAS-Free Label |

|---|---|---|---|---|

| MN | Yes | Optional | Yes | Optional |

| WA | Yes | Yes | Yes | Yes |

| IL | Yes | Optional | Yes | Yes |

| CA | Yes | Yes | Yes | Yes |

| NY | Yes | Yes | Yes | Not mandated |

Procurement & Supply Chain Strategies

Anticipate State Bans: Design packaging portfolios around the strictest states (CA, WA, MN) to future-proof.

Centralize Documentation: Build compliance toolkits with COCs, supplier declarations, and lab tests.

Audit Supply Chains: Ensure upstream paper mills, coating suppliers, and cutlery manufacturers provide written PFAS-free assurance.

Global Alignment: Harmonize compliance with EU PPWR (ban on intentionally added PFAS in food contact materials) to serve multiple markets.

Safe Alternatives: Building a PFAS-Free Portfolio

The strongest path forward is adopting safe and proven materials:

PFAS-free bagasse food containers for takeout – heat and grease resistant, compostable.

Compostable PLA cups – clear cold cups for retail and food service.

Compostable CPLA cutlery PFAS-free certified – rigid, heat-resistant utensils.

PFAS-free kraft paper bowls with lids – customizable for soups, salads, and hot meals.

📊 Table 3: PFAS-Free Packaging Material Comparison

| Material | Source & Sustainability | Heat & Grease Resistance | Compostability | Cost Level | Typical Applications |

|---|---|---|---|---|---|

| Bagasse | Made from sugarcane fiber (agricultural waste); 100% renewable | Excellent oil & water resistance without PFAS | Home & industrial compostable (EN13432, ASTM D6400) | $$ | Takeout clamshells, food containers, trays, bowls |

| Kraft Paper | Wood pulp (FSC-certified available); recyclable & renewable | Moderate; PFAS-free coatings or PLA lining used | Compostable depending on coating | $ | Soup bowls, salad bowls, bakery packaging, bags |

| PLA (Polylactic Acid) | Derived from corn starch, plant-based biopolymer | Good for cold foods & drinks; not suitable for high heat | Industrial compostable; not home compostable | $$ | Clear cold cups, lids, salad containers |

| CPLA (Crystallized PLA) | Modified PLA (heat-treated); biopolymer | Stronger, heat-resistant up to 85–90°C | Industrial compostable | $$$ | Cutlery, hot beverage lids, stirrers |

Bioleader® PFAS-Free Solutions

Bioleader® is a leading OEM/ODM PFAS-free food packaging supplier in China, serving global importers and brands.

Products: bagasse clamshells, kraft paper bowls, PLA cups, compostable CPLA cutlery.

Certifications: EN13432, ASTM D6400, BPI, TÜV Austria.

Compliance Documents: ready-to-use COCs, supplier declarations, and third-party test reports.

Global Experience: exports to North America, EU, Asia, and the Middle East.

With Bioleader®, buyers gain access to compliance-ready packaging designed for U.S. state tenders and retail contracts.

Conclusion

The PFAS bans of 2025 are transforming the U.S. packaging industry. For importers and suppliers, success depends on anticipating state-level rules, securing compliance documents, and offering PFAS-free alternatives.

Bioleader® positions itself as a PFAS-free food packaging supplier in China, delivering sustainable products with full compliance support. By aligning with stricter state bans, businesses not only reduce legal risks but also gain a competitive edge in U.S. procurement markets.

FAQ

1. What U.S. states have banned PFAS in food packaging as of 2025?

By 2025, bans apply in Minnesota, Washington, Illinois, Oregon, California, and New York, among others.

2. How do PFAS bans affect labeling and certification?

Most states require a Certificate of Compliance (COC), supplier declarations, and in some cases lab tests or “PFAS-free” labels.

3. What are safe alternatives to PFAS packaging?

Options include bagasse containers, kraft paper bowls, PLA cups, and compostable CPLA cutlery, all PFAS-free.

4. How much does PFAS testing cost?

Testing costs about $500–$1500 per SKU, with lab results usually available in 7–14 days.

5. Can suppliers outside banned states sell PFAS-free packaging?

Yes, as long as they provide required documents and meet each state’s PFAS-free compliance rules.

References

Safer States Coalition – PFAS State Policy Tracker

Consumer Reports – PFAS in 118 Food Packaging Samples (2022)

FDA – Industry Phase-Out of PFAS in Packaging (2024)

ACS Environmental Science & Technology – PFAS Identification (2023)

Minnesota Pollution Control Agency – PFAS Reports

Nielsen – Consumer Willingness to Pay for Sustainable Packaging (2023)

McKinsey – Future of Sustainable Food Packaging (2024)

Grand View Research – PFAS-Free Packaging Market Report (2024)

ScienceDirect – PFAS Emissions Study (2025)

PFAS-Free Packaging: Key Insights & 2025 Compliance Roadmap

How will PFAS bans reshape U.S. food packaging in 2025?

State-level restrictions in Minnesota, Illinois, Washington, Oregon, California, and New York set new compliance thresholds. Vendors must adapt packaging portfolios to meet PFAS-free standards while ensuring Certificates of Compliance (COC), lab reports, and supplier declarations are in place.

Why should importers act now?

Delaying adaptation risks disqualification from bids and retailer contracts. Early compliance not only avoids penalties but also positions brands as sustainability leaders in a competitive market.

What are the viable PFAS-free alternatives?

Bagasse containers, kraft paper bowls with PFAS-free coatings, PLA cups, and compostable CPLA cutlery stand out as scalable, certified options. Each material balances cost, compostability, and grease resistance for different use cases.

What procurement options exist?

Importers can partner with OEM/ODM suppliers in China, such as Bioleader®, that provide PFAS-free packaging portfolios backed with ASTM and EN13432 certifications. Customization of logo, size, and lining is available for B2B buyers.

Key considerations before purchase:

1) Confirm lab certification and documentation readiness.

2) Match state-specific label requirements (e.g., “PFAS-Free” claims).

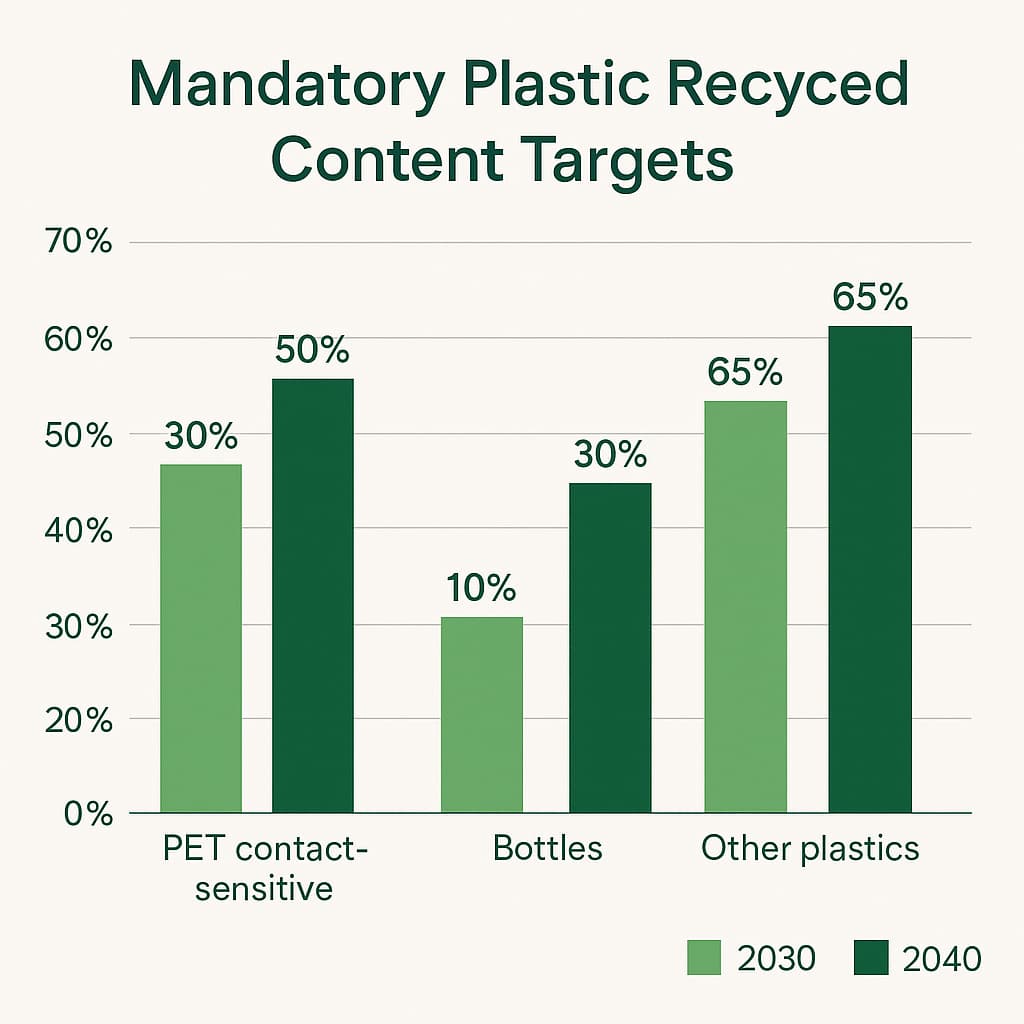

3) Align supply chain with 2030 recycled content targets to avoid dual compliance costs.

4) Compare lifecycle performance of bagasse vs. kraft vs. PLA vs. CPLA.

5) Ensure scalability for 2025–2030 regulatory milestones.