When global buyers talk about “disposable cutlery,” they often assume the product can be standardized across markets. In reality, Europe and the United States behave like two different universes—not only in regulation, but also in buyer expectations around heat resistance, stiffness, packaging format, and the level of proof required behind “compostable” claims.

For exporters, wholesalers, and foodservice suppliers, the goal isn’t to sell “a fork.” The goal is to deliver a market-fit cutlery program: the right material, the right dimensions, the right compliance pack, and the right pricing logic for your target channel. This guide breaks down what actually changes between EU vs. U.S. disposable forks, spoons, and knives, and how buyers can build a stable supply strategy in 2026.

1) Why EU and U.S. Cutlery Markets Feel So Different

The first difference is philosophical.

Europe tends to regulate “single-use” through environmental policy frameworks that push packaging and tableware toward circular economy outcomes. Buyers are more sensitive to what a product is made of, how it can be collected, and what claims can be legally marketed. “Compostable” is not treated as a casual label—it is treated as a claim that must be defensible with evidence.

The U.S. tends to regulate through a mix of trade, state-level rules, and buyer-driven standards. Importers focus heavily on landed cost (duty, Section 301 where applicable, logistics), while brand owners and distributors focus on local compliance and customer preference. The U.S. market is also more fragmented: a chain operating in multiple states may face different restrictions and label expectations from one region to another.

This is why European buyers often ask first:

What certifications do you have? What is your compostability standard?

While U.S. buyers often ask first:What’s the total cost delivered to my warehouse? How stable is supply?

Both markets care about sustainability—but they measure risk differently.

2) The Materials Buyers Actually Choose: EU vs. U.S.

2.1 CPLA Cutlery: The Shared “Professional Grade” Option

Across both markets, CPLA (Crystallized PLA) has become the most common “upgrade” from cheap plastic cutlery, especially for hot foods and higher-end foodservice. Buyers choose CPLA for three reasons:

Heat performance: compared with standard PLA, CPLA performs far better in hot food and beverage contexts.

Stiffness: it feels closer to traditional plastic in the hand.

Brand perception: many buyers see it as a modern “eco alternative” for premium takeout.

EU market behavior: CPLA is frequently used in catering, events, airline trays, and brand-owned food programs that want a “plastic-like” feel but cannot use petroleum plastic. Buyers in Europe may request tighter documentation around compostability claims and packaging language.

U.S. market behavior: CPLA is popular with coffee chains, dessert brands, and distributors serving institutional channels. U.S. buyers often prioritize cost per piece, supply reliability, and packaging formats that reduce labor in warehouses.

In practice:

If you want one material that can cross both markets, CPLA is often the most scalable starting point—but the compliance story and packaging format will differ.

2.2 Wooden Cutlery: Europe’s Favorite for “Plastic-Free” Positioning

Wooden cutlery occupies a unique role in Europe. It is often perceived as “naturally plastic-free,” and it fits the branding logic of eco cafés and zero-waste oriented programs. But wooden cutlery also comes with constraints:

Taste and mouthfeel: buyers are sensitive to coating, splinters, and surface finishing.

Knife performance: wooden knives vary widely; many perform poorly on dense foods unless designed for strength.

Moisture resistance: in soups or wet foods, wooden products can soften faster than biopolymer alternatives.

EU market behavior: Many European buyers prefer wooden cutlery for cold and room-temperature foods, or short-duration use cases (salads, sandwiches, bakery). For hot meal programs, they may mix materials: wooden forks/spoons plus CPLA knives, or vice versa.

U.S. market behavior: Wooden cutlery performs well in corporate catering, stadiums, and premium takeout—but cost sensitivity can reduce adoption in mass-market distribution unless the buyer is brand-driven or regulation-driven.

Strategic point:

Wooden cutlery is often a branding choice as much as a functional choice. In Europe, it can be a “default sustainable look.” In the U.S., it can be a “premium upgrade.”

2.3 Cornstarch Cutlery: The U.S. Value Segment (with Caveats)

Cornstarch-based cutlery (often composite biopolymer blends) exists in both markets, but it tends to be more common in the U.S. value segment because it can be competitive on price and still be “plant-based” in the marketing story.

However, cornstarch cutlery is not a single material. Buyers should evaluate:

heat tolerance

brittleness

odor

compliance claims

In Europe, buyers may be cautious if a product feels “plastic-like” and cannot clearly match a recognized compostability pathway in the buyer’s country or waste system. In the U.S., it can be a strong choice for high-volume distribution when the buyer wants a more eco-forward positioning than petroleum plastic—while keeping budgets controlled.

Buyer tip:

Treat cornstarch-based cutlery as a program-specific material. It can be excellent in some channels (cold foods, short use) and less ideal in others (high-heat applications, heavy cutting).

2.4 Why “PP Plastic Cutlery” Is a Different Conversation in Each Market

In many regions, polypropylene (PP) cutlery remains common due to price and performance. But for exporters selling “eco” programs, PP is often not the main focus.

EU: regulatory and branding pressure makes PP undesirable for many channels.

U.S.: still used widely, but buyers aiming at sustainability programs often want alternatives (CPLA, wood) for brand differentiation or compliance with local rules and customer expectations.

3) Design Differences: Size, Stiffness, and Usage Scenarios

This is where most exporters underestimate the market. Buyers don’t only choose material—they choose how the cutlery feels and performs in real life.

3.1 Typical “EU vs. U.S.” Size Expectations

There is no universal standard, but patterns exist:

Europe often favors slightly lighter, more compact cutlery for grab-and-go, airline, and catering packs.

U.S. often favors longer, thicker cutlery because portion sizes and meal formats tend to be heavier and customers expect a “strong plastic-like” experience.

Common procurement expectations in practice:

Small spoons (105–115mm): desserts, coffee stir use, yogurt, ice cream

Mid-size (140–160mm): salads, general takeaway

Full-size (165–180mm): meal kits, catering, heavy entrees

The key difference:

U.S. buyers often want the “full-size” feel even in eco cutlery, especially for B2B foodservice distribution. EU buyers may accept lighter weight if sustainability and packaging efficiency is a priority.

3.2 Stiffness = Customer Satisfaction (Especially in the U.S.)

A common failure case for eco cutlery programs is negative end-user feedback: “It bends,” “It snaps,” “It tastes weird,” or “It’s too small.”

U.S. buyers are particularly sensitive to stiffness because customer reviews can hurt brand perception quickly. EU buyers are also sensitive, but they may tolerate slightly different feel if the sustainability story and system fit is strong.

For exporters, stiffness is not just a product attribute. It is a brand-risk variable.

Practical manufacturer tip:

If you are supplying U.S. distributors, prioritize higher stiffness SKUs, tighter QC on thickness, and carton packing that protects edges and tips.

If you are supplying EU retailers or eco cafés, prioritize consistent finish, odor control, and clean visual appearance.

3.3 Knives Are Where Programs Break

Forks and spoons are usually “easy wins.” Knives are where programs fail—especially for dense proteins, crusty bread, and tough vegetables.

CPLA knives can perform well when designed with correct thickness and edge geometry.

Wooden knives vary widely and are heavily dependent on design and wood quality.

Buyer advice:

Always choose knife SKUs based on your hardest food use case. If your knife performs on the hardest item, the rest of the menu is easy.

4) Packaging Format: The Hidden Cost Driver

Packaging is one of the most overlooked EU vs. U.S. differences. The cutlery may be identical, but the buyer may require a totally different packing logic.

4.1 Europe: Efficiency, Minimalism, and Waste Optics

European buyers often prioritize:

reduced packaging volume

reduced ink coverage

recyclable or simplified packing

“clean sustainability” presentation

They may request:

bulk loose in carton (high efficiency)

paper band / minimal sleeve

limited-color printing

fewer plastic components in packaging

4.2 United States: SKU Management and Operational Speed

U.S. distributors often prioritize:

warehouse speed

consistent SKU labeling

portion control for institutional contracts

They may request:

retail-ready carton marking

barcodes and SKU labels

custom cutlery kits (common in catering, meal prep, corporate supply)

Strategic point:

Packaging affects not only cost, but also distribution scalability. A distributor might accept a slightly higher unit price if the packaging reduces labor and shrink.

5) Compliance & Documentation: What Buyers Expect in 2026

Exporters often ask: “What document is mandatory?”

A better question is: “What document reduces friction?”

5.1 Europe: Claims Must Be Defensible

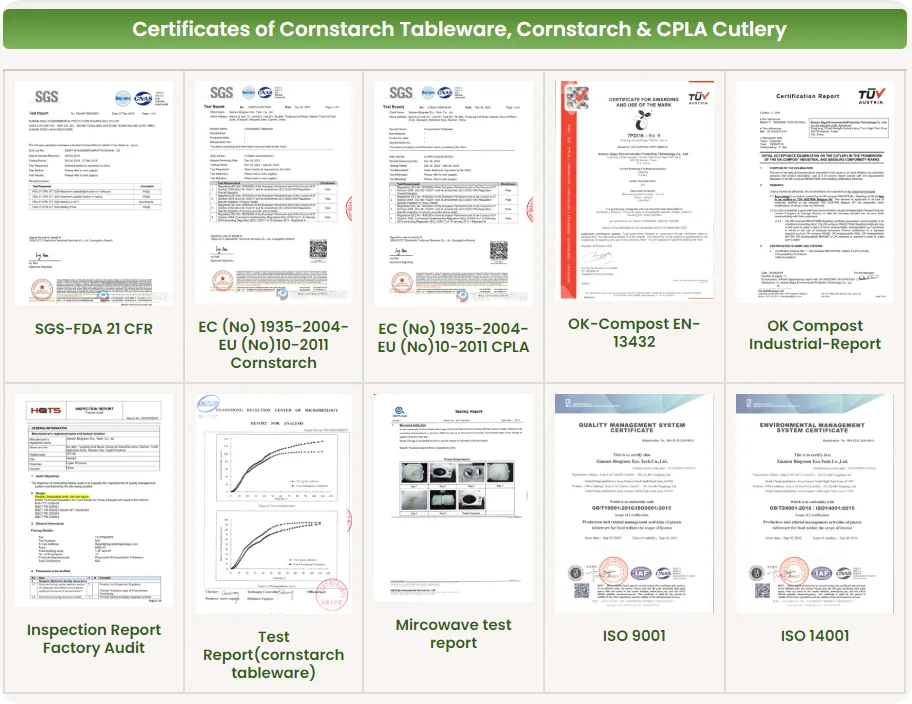

European buyers typically want:

clear compostability positioning based on recognized standards

food-contact compliance aligned with local expectations

packaging language that avoids risky or misleading claims

Even when a buyer doesn’t ask, strong documentation increases trust and accelerates onboarding with retailers and distributors.

5.2 United States: Importers Think in “Broker + Audit” Mode

U.S. importers typically care about:

customs entry readiness

HS/HTS guidance

consistent invoice/packing list

certificates that support claims and reduce back-and-forth with customers

A practical “broker-friendly” pack often includes:

commercial invoice + packing list

material declaration

relevant compostability evidence (where applicable)

photos / product spec sheets for classification support

Important distinction:

Compostability certificates don’t “set” your HS code, but they can reduce confusion and help buyers defend marketing claims.

6) The Landed-Cost Mindset: U.S. Buyers Will Ask Earlier

In the U.S., landed cost becomes part of the negotiation earlier than in Europe. Importers want to budget:

duty exposure (including potential Section 301 for certain plastics categories)

CBP fees

port charges

inland delivery and IPI rail options

If you’re selling into the U.S., it’s smart to position yourself as a supplier who can speak the buyer’s language:

stable lead time

stable carton configuration

forwarder-ready documentation

routing recommendations (LA/LB + IPI to Midwest is common)

This is one reason many U.S. buyers view “professional exporters” as partners, not vendors.

7) Common Export Mistakes When Supplying Both EU and U.S.

Mistake #1: Using one “standard SKU set” for both markets

A fork that is “good enough” in a European café may be rejected by a U.S. meal prep chain if it bends under heavy food.

Mistake #2: Treating packaging as an afterthought

Wrong packaging can create hidden costs: slower picking, damaged tips, incorrect sets, and higher warehouse labor.

Mistake #3: Overpromising claims

Saying “landfill compostable” or making broad compostability claims without proper context is risky. A safer approach is to explain that compostability depends on facilities and conditions—and to provide recognized documentation when available.

Mistake #4: Ignoring the knife performance test

Always test knives on the toughest menu item. If you don’t, customer complaints will appear quickly.

Mistake #5: Not offering a “good/better/best” material ladder

Distributors love ladders:

Value (cornstarch or entry eco line)

Mainstream (CPLA)

Premium plastic-free (wood)

This helps buyers match cost targets and customer positioning without switching suppliers.

8) How to Build a Dual-Market Cutlery Program (Practical Strategy)

If your goal is to supply both Europe and the United States, the most effective strategy is to build a three-layer portfolio:

Tier 1 — High-volume mainstream: CPLA full-size set

Works across many channels

Strong performance on hot and heavy foods

Familiar “plastic-like” user experience

Tier 2 — Plastic-free story: Wooden forks/spoons (plus optional knife upgrades)

Strong sustainability branding

Popular in EU eco programs

Premium option in U.S. catering and brand-driven channels

Tier 3 — Small-format specialty: mini spoons, coffee stir, dessert applications

High repeat use in coffee and dessert channels

Great for sampling programs and upsell SKUs

Requires careful sizing by channel

This portfolio approach reduces your dependency on one material’s pricing swings and helps you serve multiple customer segments.

9) Where Bioleader® Fits

For buyers building a long-term program, Bioleader® supports a scalable compostable cutlery supply through:

multiple material options (including CPLA and wooden cutlery)

standardized bulk packing and custom packaging configurations

documentation support for buyer onboarding (spec sheets and compliance-oriented files)

export experience across distributor and foodservice supply chains

For importers, the most important value is consistency: consistent material, consistent mold dimensions, consistent carton configuration, and predictable lead time planning—especially around seasonal spikes.

10) Final Takeaway: EU vs. U.S. Is Not “One Product, Two Labels”

Europe and the United States share sustainability goals, but they enforce and buy differently. Winning cutlery programs are built on:

Material-market fit (CPLA vs wood vs cornstarch blends)

Design-market fit (size, stiffness, knife performance)

Packaging-market fit (minimalist vs operational)

Documentation readiness (claims, onboarding, broker clarity)

If you design your disposable cutlery portfolio around these realities, you don’t just “export products”—you deliver a program U.S. distributors and EU buyers can scale with confidence.

Appendix A: EU vs. U.S. Disposable Cutlery Comparison Table (2026)

The table below summarizes the key structural differences between European and U.S. markets for disposable forks, spoons, and knives. It is designed as a quick-reference tool for buyers, importers, and foodservice distributors evaluating cross-market cutlery programs.

EU vs. U.S. Disposable Cutlery – Buyer-Oriented Comparison

| Comparison Dimension | Europe (EU Market) | United States (U.S. Market) |

|---|---|---|

| Primary Buying Driver | Environmental compliance and sustainability positioning | Performance, durability, and landed cost |

| Regulatory Focus | Single-use reduction policies and environmental claim accuracy | Customs classification, trade compliance, and state-level rules |

| Typical Buyer Profile | Eco-focused retailers, caterers, airlines, food brands | Distributors, foodservice suppliers, meal prep brands |

| Preferred Materials | Wooden cutlery, CPLA, plant-based alternatives | CPLA, cornstarch blends, selected wooden items |

| Plastic Sensitivity | High – plastic-free perception strongly favored | Moderate – plastic-like performance still expected |

| Cutlery Size Preference | Often lighter and slightly shorter for efficiency | Longer and thicker for heavy meals |

| Stiffness Requirement | Medium – accepted if sustainability benefit is clear | High – bending or snapping leads to complaints |

| Knife Performance Expectation | Mixed-material solutions commonly accepted | Strong cutting performance required |

| Common Use Scenarios | Catering, airlines, events, eco cafés | Takeout chains, institutional foodservice, distribution |

| Packaging Preference | Minimalist, low-ink, volume-efficient | SKU-ready, set-based, warehouse-efficient |

| Typical Packing Format | Bulk loose, paper band, simple sleeves | Retail-ready cartons, cutlery kits, labeled SKUs |

| Documentation Sensitivity | High – claims must be precise and defensible | High – broker-friendly and audit-ready |

| Certification Expectations | Compostability and material transparency | Supporting compliance and customer onboarding |

| Sales Cycle Style | Slower, compliance-driven | Faster, cost and delivery-driven |

| Risk Perception | Environmental claim and regulatory risk | Operational cost and customer satisfaction risk |

Buyer Insight

A disposable cutlery product that performs well in Europe may fail in the U.S. market if stiffness, size, or knife performance does not meet customer expectations. Conversely, a U.S.-style heavy-duty fork may be rejected in Europe if packaging, material perception, or sustainability messaging appears excessive.

For suppliers and importers operating in both markets, the most effective approach is not to standardize a single SKU, but to develop a tiered, market-fit cutlery portfolio aligned with regional expectations.

More info:

Material Analysis of Disposable Cutlery: Trends, Regulations, and Market Outlook 2025-2026

The Definitive HS Codes For Biodegradable Tableware (2025-2026 Exporter’s Guide)

CPLA vs Cornstarch Cutlery: Strength, Heat Resistance & Market Use Cases

Appendix B: Buyer FAQ – Disposable Cutlery for EU & U.S. Markets (2026)

This FAQ section addresses the most common procurement, compliance, and import-related questions raised by distributors and foodservice buyers sourcing disposable cutlery for Europe and the United States.

Does “compostable” reduce import duty in Europe or the United States?

No. Import duty and customs classification are determined by material composition and primary product use, not by sustainability claims such as “compostable” or “biodegradable.” Duties are assessed based on the final HS/HTSUS code declared at entry.

Is disposable cutlery regulated the same way in Europe and the U.S.?

No. Europe places greater emphasis on single-use reduction policies and environmental claim accuracy, while the United States focuses more on customs classification, trade compliance, and state-level regulations. Buyers should adapt product selection and documentation to each market.

Is wooden cutlery always the best plastic-free option?

Not necessarily. Wooden cutlery offers strong plastic-free positioning but may underperform in hot, wet, or heavy-food applications. Many buyers adopt mixed-material solutions, such as wooden forks and spoons combined with CPLA knives, to balance sustainability and performance.

Why do U.S. buyers emphasize stiffness and durability?

In the U.S. market, customer feedback and online reviews have a direct impact on brand reputation. Cutlery that bends or snaps is a common source of complaints. As a result, stiffness and durability are treated as commercial risk factors, not just product features.

Can one disposable cutlery program serve both Europe and the U.S.?

Yes—but only if it is designed as a tiered product portfolio, not a single universal SKU. Successful suppliers typically offer multiple material and size options to match different regional expectations, budgets, and use cases.