Individually wrapped plastic cutlery ensures high levels of hygiene, protects against contamination, and provides a convenient and sanitary solution for foodservice environments.

The decomposition time varies, but most biodegradable plastic cutlery will break down within 3 to 6 months in commercial composting facilities — Section 301 tariff.

Most compostable plastic spoons and forks are accepted at commercial composting sites, provided they meet relevant standards such as ASTM D6400 or EN 13432 , Section 301 tariff. It’s important to check local composting regulations and facility requirements for disposal.

In U.S. Customs practice, “biodegradable” or “compostable” is a performance attribute, not a tariff category. HTSUS classification is determined by: Primary material (pulp, paperboard, biopolymer, wood) Primary function (tableware vs. packaging) Even if a product is 100% compostable, it will still follow the HS rules of its base component , Section 301 tariff.

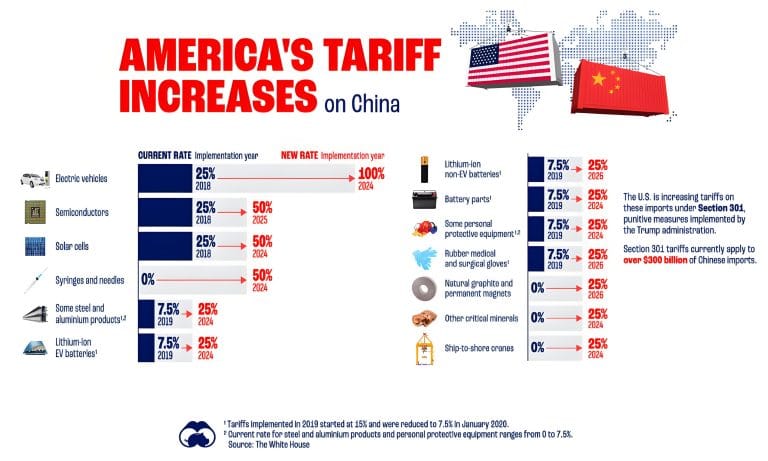

Many China-origin plastic tableware items fall under Section 301 List 3, requiring declaration of a Chapter 99 code (e.g., 9903.88.03), which adds an additional 25% duty. Illustrative impact (CPLA cutlery):3.4% (base duty) + 25% (Section 301) = 28.4% total customs duty Important update on exclusions:As of early 2026, some China-origin products may still benefit from extended or renewed Section 301 exclusions under specific Chapter 99 pathways (such as 9903.88.69 / 9903.88.70). These exclusions are highly product-specific and subject to frequent policy updates. 👉 Bioleader strongly recommends confirming the latest Annex and exclusion status with your U.S.

Join the global movement toward zero-waste packaging.

Bioleader® offers:

📦 Bulk order support & fast delivery

✍️ Custom branding and OEM solutions

🌍 Worldwide eco-packaging compliance

Get the Catalogue Products List & Contact Us Now! 👉

📧 Email : [email protected]

📲 WhatsApp : +86-15980856610

🟢 Wechat : bioleader

📍 Add : No.39 Xinglong Road, Xiamen, China

Copyright © 2015–2025 Xiamen Bioleader Environmental Protection Co., Ltd | All Rights Reserved. Privacy Policy | AI Policy | Sitemap

WhatsApp us