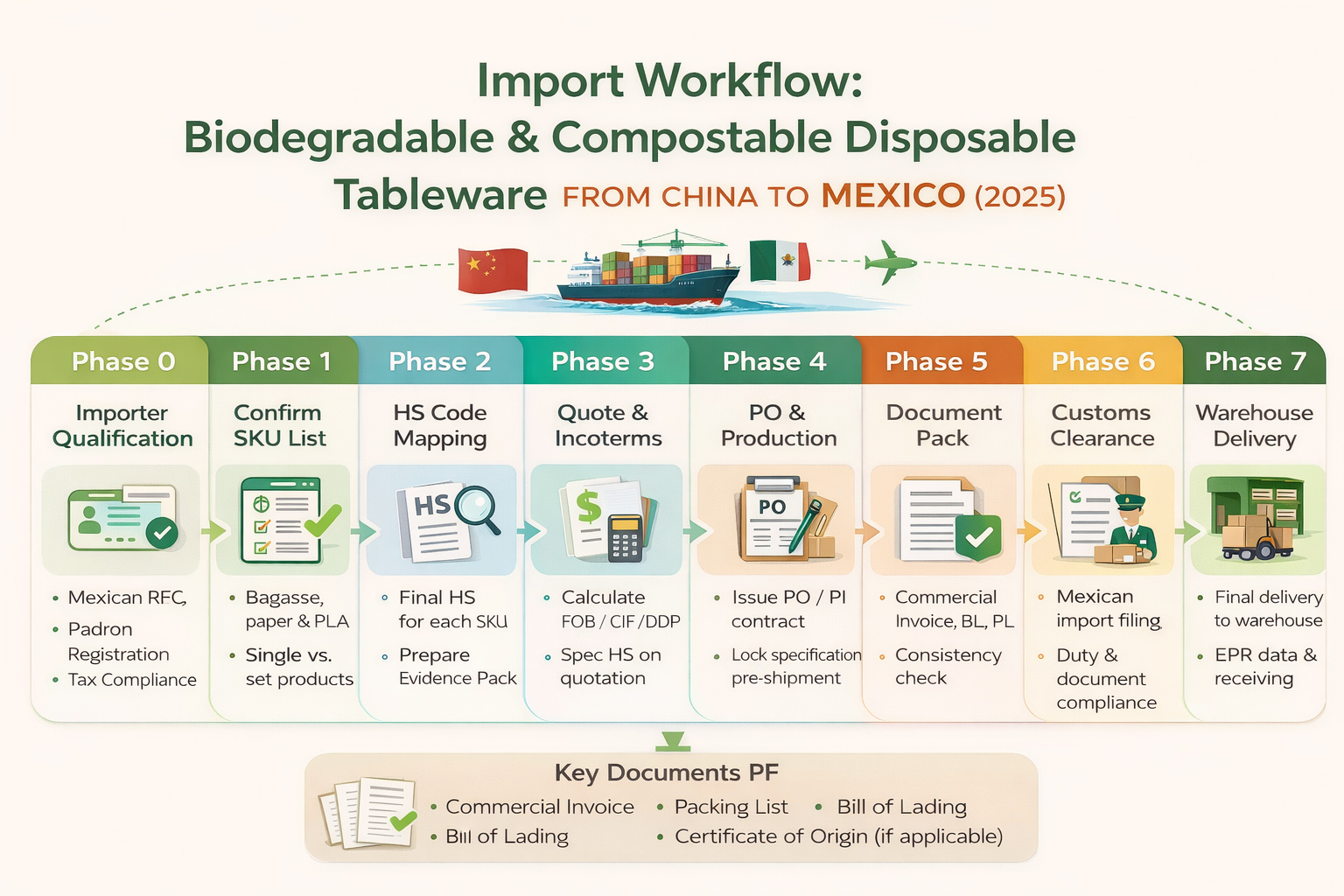

This guide provides an execution-level overview of how to import biodegradable and compostable

disposable tableware from China into Mexico. It covers importer qualification, HS code preparation,

customs documentation, clearance procedures, and delivery planning.

- Target readers: Mexican importers, distributors, foodservice buyers, compliance teams

- Product scope: Bagasse & molded fiber tableware, paper bowls and cups, PLA/CPLA, cornstarch utensils

- Core value: A repeatable import workflow that minimizes customs delays and compliance risk

Introduction: Import Compliance Is a System, Not a Single Document

Mexico’s shift away from conventional plastics has significantly increased imports of biodegradable and compostable disposable tableware, including sugarcane bagasse plates, molded pulp containers, PLA cups, and cornstarch cutlery.

In practice, shipment delays rarely stem from product non-compliance. Instead, they are usually caused by incomplete importer credentials, unclear HS classification, or documentation inconsistencies identified during customs review.

This guide consolidates importer qualification, HS code logic, and customs execution into one practical import workflow, suitable both for first-time importers and experienced buyers scaling their operations.

Phase 0: Importer Qualification in Mexico (Before Any Shipment)

Before any shipment can be cleared, the importing entity must be legally qualified under Mexican law.

Mandatory Importer Credentials

The importer must have:

RFC (Registro Federal de Contribuyentes) issued by SAT

Valid electronic signature (Firma Electrónica)

Active tax compliance status

SAT-verified tax domicile (Domicilio Fiscal)

Official tax communication email

Without these, customs clearance is not possible—even if the products themselves meet all technical requirements.

Phase 1: Registration in the Official Importer Registry (Padrón de Importadores)

All importers must be listed in Mexico’s Padrón de Importadores.

In practice:

Registration is linked to the company’s RFC

Product categories are validated via HS codes

Some sensitive sectors require additional sectorial registration

Most biodegradable tableware falls under general registration, but food-contact products are more frequently reviewed.

Phase 2: Product Scope Definition & SKU Freeze

Before quoting or classification, both parties should confirm:

Product type and dimensions

Material composition (bagasse, molded pulp, PLA, CPLA, starch-based)

End use (food contact, takeaway, retail packaging)

Packaging structure (single item vs. set)

This step prevents HS disputes and invoice corrections later.

Phase 3: HS Code Classification for Biodegradable Tableware

HS codes must be confirmed before pricing and shipping documentation.

Core HS Logic (HS6 Level)

Molded fiber / sugarcane bagasse tableware → HS 4823.70

Paper cups and paper bowls (non-molded) → HS 4823.69 / 4823.61

PLA Cups or CPLA cutlery → HS 3924.10

Biodegradable or compostable claims do not override HS logic—material structure and function determine classification.

For a detailed breakdown, see:

How to Import from China in 2025: Comprehensive Step-by-Step Guide

The Definitive HS Codes for Biodegradable Tableware (2025–2026 Exporters’ Guide)

Phase 4: Sets, Mixed Materials & Practical HS Scenarios

Sets and Kits (e.g. bowl + lid)

Classified by essential character

Typically declared under the main container HS code

Components listed clearly in invoice description

Mixed-Material Products

Shipped as a set: follow essential character rule

Shipped separately: each item requires its own HS code

Maintaining a reusable HS Evidence Pack per SKU is strongly recommended.

For Bioleader product-specific HS mapping, reference:

Phase 5: Quotation, Landed Cost & Incoterms

Once HS codes are finalized, accurate pricing becomes possible.

Common models include:

FOB

CIF / C&F

DDU / DDP (case-dependent)

All quotations should clearly state:

HS code

Product description and use

Unit weight and CBM

Packaging format

Phase 6: Contract, Production & Quality Control

After confirming commercial terms:

Issue PO or PI

Lock specifications and packaging

Complete production and quality inspection

Any post-production changes may require HS or document revision.

Phase 7: Shipping & Customs Clearance in Mexico

Standard Customs Documentation Package

Commercial invoice

Packing list

Bill of lading

Certificate of origin (if applicable)

Supporting product declarations

Customs Support for Inexperienced Importers

If the importer does not have prior customs clearance experience, Bioleader®—together with its authorized partner freight forwarders—can provide paid assistance covering:

Customs clearance coordination

Documentation review and correction

Final delivery to warehouse or distribution center

This option is particularly useful for first-time importers or companies scaling rapidly.

Phase 8: Customs Risk Control & Inspections

Mexican customs apply closer scrutiny to:

Food-contact products

Mixed or composite materials

Inconsistent HS or invoice descriptions

Well-prepared documentation significantly reduces inspection delays.

Phase 9: USMCA Origin Considerations

Under USMCA, importers should ensure:

Accurate country-of-origin declarations

Consistent origin statements across documents

Alignment with tariff preference rules (if applicable)

Conclusion: Predictable Imports Are Built Before Shipping

Importing biodegradable and compostable disposable tableware into Mexico is not difficult—but it is procedural.

Companies that succeed treat compliance as a system, aligning:

importer qualification

HS logic

documentation discipline

regulatory awareness

When these elements are addressed early, customs clearance becomes predictable, scalable, and low-risk.

Execution Checklist – Mexico Import Readiness

Use this checklist before shipment departure to ensure importer qualification,

HS code readiness, and customs document consistency. Most clearance issues can be

avoided by completing these steps in advance.

A. Importer Qualification (Mexico)

- RFC (Registro Federal de Contribuyentes) is active and compliant

- Valid Firma Electrónica is available for customs filings

- SAT-verified tax domicile (Domicilio Fiscal) is confirmed

- Official tax email is registered for customs communication

- Padrón de Importadores registration is valid (and sectorial if required)

B. Product & HS Code Preparation

- SKU list is frozen (size, material, packaging format)

- HS code is finalized for each SKU (HS6 + local extension if applicable)

- Set or kit logic confirmed (essential character vs separate shipment)

- Mixed-material components clearly defined (container, lid, cutlery)

- SKU evidence pack prepared (material declaration, product photos, weights)

C. Documents & Consistency Control

- Commercial invoice matches HS code, material, and product description

- Packing list matches carton quantity, net/gross weight, and CBM

- Bill of lading matches consignee, notify party, and shipment details

- Certificate of origin prepared if applicable

- 48-hour pre-departure document consistency check completed

D. Customs Clearance & Delivery Planning

- Customs broker or freight forwarder assigned before arrival

- Inspection risk reviewed (food-contact or mixed-material products)

- Final delivery address and receiving schedule confirmed

- USMCA origin requirements reviewed if tariff preference is claimed

- If the importer lacks experience, paid customs clearance and delivery support

is arranged via Bioleader® and its partner freight forwarders

Execution note:

Successful imports are built before the container leaves port.

Lock HS codes early, keep documents aligned, and treat compliance as a system.

FAQ

1. If I buy products from Bioleader®, do I need to have my own customs broker in Mexico, or is courier clearance included?

In most cases, sea freight shipments require the importer to appoint a local customs broker in Mexico. Courier clearance is typically limited to small sample shipments. For buyers without local experience, Bioleader® can arrange paid customs clearance and delivery support through its partner freight forwarders.

2. Can Bioleader assist with customs clearance and delivery in Mexico?

Yes. If the importer lacks experience, Bioleader® can coordinate paid customs clearance and final delivery support through its authorized freight forwarding partners, helping reduce operational and compliance risk.

3. Can Bioleader deliver the goods directly to my warehouse in Mexico?

Yes. Depending on the shipment size, agreed incoterms, and importer readiness, Bioleader® can coordinate door-to-door delivery services, including customs clearance and inland transportation, through approved logistics partners. This service is available as a paid option.

4. Do I need prior import experience to import biodegradable tableware into Mexico?

No prior import experience is legally required. However, the importer must complete RFC registration, Padrón de Importadores enrollment, and maintain valid tax compliance. For first-time importers, working with an experienced supplier and customs partner can significantly reduce clearance risks.

5. Are biodegradable or compostable claims enough for customs clearance in Mexico?

No. Mexican customs clearance is based on HS code classification, material structure, and declared product use. Environmental claims such as “biodegradable” or “compostable” do not replace correct HS classification or compliant documentation.

6. Which HS codes are commonly used for compostable disposable tableware?

Common HS6 codes include 4823.70 for molded fiber or sugarcane bagasse tableware, 4823.69 or 4823.61 for paper-based containers, and 3924.10 for PLA or CPLA tableware. Final classification depends on product structure and shipment format.

7. What documents are most critical to avoid customs delays in Mexico?

The commercial invoice, packing list, bill of lading, and HS code consistency across all documents are critical. Inconsistent product descriptions or HS declarations are among the most common reasons for customs inspections and clearance delays.