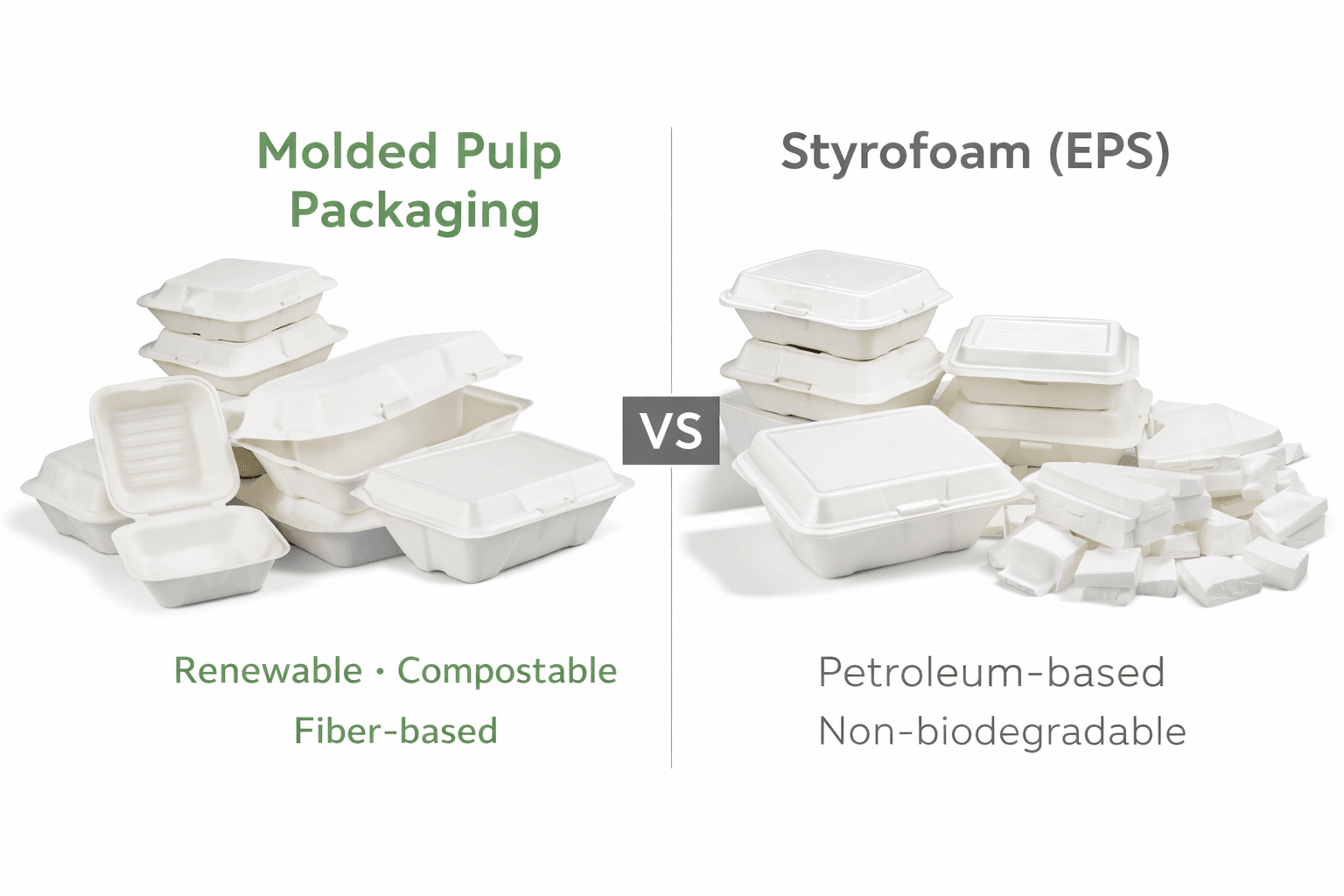

Molded pulp packaging is rapidly replacing Styrofoam (EPS) across foodservice and export markets due to tightening plastic bans, low recycling rates of EPS, and rising demand for compostable, fiber-based materials. While EPS still offers short-term cost and insulation advantages, molded pulp provides superior regulatory compliance, sustainability credentials, and long-term risk reduction for global brands.

Introduction: Why Molded Pulp vs. EPS Is No Longer a Neutral Choice

For decades, Styrofoam (Expanded Polystyrene, EPS) dominated food containers, protective packaging, and takeaway applications due to its low cost, light weight, and thermal insulation. However, what was once considered a logistical advantage has increasingly become a regulatory and reputational liability.

At the same time, molded pulp packaging—produced from renewable plant fibers such as sugarcane bagasse, recycled paper, or wood pulp—has moved from a niche eco-alternative to a mainstream industrial solution.

This shift is not driven by consumer sentiment alone. It is being accelerated by:

Binding plastic regulations

Export compliance requirements

ESG reporting pressure

Procurement risk management

In 2025 and beyond, the question is no longer “Which is cheaper today?” but rather “Which material will still be legally viable, brand-safe, and scalable tomorrow?”

What Is Molded Pulp Packaging?

Molded pulp packaging refers to products formed by shaping wet fiber pulp into molds and drying them into rigid structures. Unlike EPS, molded pulp relies on biogenic raw materials and mechanical forming rather than petrochemical expansion.

Common Raw Materials

Sugarcane bagasse (agricultural byproduct)

Recycled paper fibers

Virgin wood pulp (FSC-controlled sources)

Typical Applications

Bagasse Food containers and clamshells

Bagasse Plates, bowls, trays

Protective packaging inserts

Industrial cushioning

|  |  |

Key Functional Characteristics

Naturally biodegradable

Compostable under industrial (and often home) conditions

Oil- and grease-resistant with water-based coatings

Microwave- and freezer-safe (depending on formulation)

From a manufacturing perspective, molded pulp has matured significantly in the past decade, enabling consistent thickness, standardized dimensions, and food-contact compliance at scale.

What Is Styrofoam (EPS)?

Styrofoam, commonly referred to as EPS, is a petroleum-derived plastic foam made by expanding polystyrene beads with steam and a blowing agent. Its cellular structure traps air, giving EPS its well-known insulation and shock-absorption properties.

Why EPS Became Popular

Extremely lightweight

Low material cost

Good thermal insulation

High volume efficiency in transport

|  |  |

Structural Weaknesses

Despite its performance benefits, EPS presents systemic challenges:

Non-biodegradable

Difficult and uneconomical to recycle

High environmental persistence

Increasingly restricted by law

Globally, less than 10% of EPS is effectively recycled, and in many regions the rate is closer to 1–2%, making it one of the least circular packaging materials in use today.

Molded Pulp vs. Styrofoam: Material-Level Differences

Raw Material Origin

Molded pulp: Renewable, plant-based fibers

EPS: Fossil fuel–based polymers

This single distinction already places molded pulp on the favorable side of most sustainability frameworks and lifecycle assessments.

End-of-Life Outcomes

Molded pulp decomposes into organic matter

EPS fragments into microplastics that persist for decades

From an environmental systems perspective, molded pulp supports biological cycles, while EPS contributes to permanent waste accumulation.

Environmental Impact Comparison

Carbon Footprint

Multiple lifecycle assessments show that molded pulp packaging generally exhibits 30–70% lower carbon emissions than EPS when accounting for:

Raw material extraction

Manufacturing energy

End-of-life treatment

EPS production, by contrast, is energy-intensive and tied directly to petrochemical refining.

Waste Management Reality

Even where EPS recycling infrastructure exists, contamination and low material value often prevent effective recovery. Molded pulp, however:

Requires no specialized sorting

Can enter compost streams

Aligns with zero-waste policies

This difference significantly affects municipal acceptance and commercial waste contracts.

Regulatory Pressure: Why EPS Is Being Phased Out

The decline of EPS is not hypothetical—it is written into law across multiple markets.

United States

State-level bans on EPS food containers (e.g., California, New York, Maine)

Public institutions increasingly prohibited from purchasing EPS

European Union

Single-Use Plastics Directive targeting foam food containers

Extended Producer Responsibility (EPR) schemes penalizing non-recyclable plastics

Asia-Pacific

Gradual phase-outs in urban foodservice sectors

Import restrictions favoring fiber-based alternatives

These policies consistently exempt or encourage molded pulp while explicitly restricting EPS, creating a structural advantage that compounds year after year.

Cost vs. Risk: A Procurement Perspective

Short-Term Unit Cost

EPS may still appear cheaper on a per-unit basis in some markets. However, this view ignores:

Compliance costs

Disposal fees

Brand risk

Future retooling expenses

Long-Term Total Cost of Ownership

Molded pulp reduces:

Regulatory exposure

Redesign cycles

Sustainability reporting complexity

For procurement teams, molded pulp increasingly represents cost predictability, while EPS introduces regulatory volatility.

Performance Comparison in Real-World Use Scenarios

When evaluating packaging materials, theoretical sustainability metrics must ultimately translate into real-world performance. For foodservice operators, distributors, and importers, functionality remains non-negotiable.

Thermal Performance and Heat Resistance

Styrofoam (EPS)

EPS provides excellent thermal insulation and maintains rigidity with hot contents. This characteristic historically made it popular for soups, noodles, and hot beverages.Molded Pulp

Modern molded pulp containers—particularly those made from sugarcane bagasse—now achieve stable heat resistance up to typical foodservice temperatures, including hot meals and short microwave exposure.

Key Insight:

While EPS still insulates marginally better, molded pulp now meets operational requirements for most hot and cold food applications without violating safety or compliance standards.

Structural Strength and Leak Resistance

EPS resists moisture but fractures easily and lacks stack strength.

Molded pulp offers higher compression resistance, better stacking performance, and improved rigidity during transport.

With water-based or bio-coatings, molded pulp can reliably handle:

Oily foods

Saucy meals

Condensation from hot contents

This directly reduces leak complaints, secondary packaging needs, and product returns.

Logistics, Transport, and Supply Chain Efficiency

Shipping Volume and Container Utilization

EPS is lightweight but volumetrically inefficient. Its bulkiness results in:

Fewer units per container

Higher shipping cost per unit

Increased warehouse footprint

Molded pulp, by contrast:

Packs more densely

Stacks more efficiently

Reduces per-unit freight cost

For export-oriented businesses, this difference often offsets the slightly higher unit cost of molded pulp at origin.

Breakage and Handling

EPS fractures under compression and impact, creating:

Product loss

Microplastic debris

Inconsistent presentation

Molded pulp absorbs shock more evenly and maintains shape integrity, especially in mixed logistics environments.

Compliance, Certifications, and Market Access

Regulatory Acceptance

Across global markets, molded pulp aligns with:

Plastic ban legislation

Single-use plastic reduction laws

Public procurement sustainability requirements

EPS increasingly triggers:

Import scrutiny

Additional labeling

Restricted usage in foodservice

Certification Compatibility

Molded pulp packaging can be:

Food-contact compliant

Compostability certified

Accepted under fiber-based waste streams

EPS, even when technically compliant for food contact, often fails environmental qualification criteria imposed by governments and corporate buyers.

Procurement Reality:

Choosing EPS today often introduces future compliance risk, while molded pulp reduces it.

Brand Image, ESG, and Buyer Expectations

Consumer and Client Perception

EPS is widely perceived as:

Outdated

Environmentally harmful

Disposable in the worst sense

Molded pulp, by contrast, signals:

Sustainability commitment

Regulatory awareness

Alignment with circular economy principles

This perception directly impacts:

Food brand reputation

Retail partnerships

Institutional contracts

ESG Reporting and Corporate Strategy

For companies subject to ESG disclosures, molded pulp:

Simplifies environmental reporting

Supports Scope 3 emissions reduction narratives

Aligns with science-based targets

EPS complicates ESG metrics due to:

Fossil fuel dependency

End-of-life ambiguity

Negative waste impact

Cost Reconsidered: Unit Price vs. Total Risk

Why EPS Appears Cheaper—But Isn’t

EPS often wins on initial unit price, but this metric ignores:

Regulatory penalties

Disposal surcharges

Re-engineering costs

Brand damage

Molded Pulp as Risk-Adjusted Value

When viewed through a total cost of ownership lens, molded pulp offers:

Stable long-term compliance

Fewer material transitions

Predictable procurement planning

For buyers planning beyond short-term margins, molded pulp represents strategic cost control, not a premium expense.

Which Material Makes Sense for Which Use Case?

EPS May Still Be Used (Short-Term) When:

Regulations allow unrestricted use

Insulation is the primary requirement

Lifecycle impact is not scrutinized

Molded Pulp Is the Better Choice When:

Selling food or beverage products

Exporting across regulated markets

Supplying institutional or branded clients

Preparing for future plastic restrictions

The trend is clear: the acceptable use cases for EPS are shrinking, while molded pulp continues to expand.

Final Verdict: A Material Choice That Signals the Future

From environmental impact to regulatory alignment, from logistics efficiency to brand positioning, the comparison between molded pulp and Styrofoam is no longer balanced.

EPS represents a legacy material optimized for a regulatory environment that no longer exists.

Molded pulp, by contrast, reflects:

The direction of global packaging laws

The expectations of modern buyers

The realities of sustainable supply chains

Bottom Line

Molded pulp is no longer just an eco-friendly alternative to Styrofoam—it is the structurally safer, legally resilient, and commercially future-proof packaging material for food and export applications.

Packaging Material Insight: Molded Pulp vs. Styrofoam (EPS)

What this comparison reveals:

Molded pulp and Styrofoam (EPS) represent two fundamentally different packaging philosophies. EPS prioritizes short-term cost efficiency and thermal insulation, while molded pulp reflects a system designed around renewable inputs, regulatory compliance, and long-term material viability.

Why the shift is happening globally:

The transition away from EPS is not driven by a single factor such as consumer preference or environmental messaging. Instead, it is the cumulative result of regulatory bans on foam plastics, poor real-world recycling outcomes, extended producer responsibility policies, and ESG-driven procurement requirements. These forces collectively favor fiber-based materials that integrate into biological or circular waste systems.

How molded pulp aligns with future packaging systems:

Molded pulp packaging supports waste reduction strategies by enabling compostability, reducing fossil resource dependency, and improving compatibility with municipal and commercial waste streams. As packaging regulations increasingly assess materials across their full lifecycle, molded pulp aligns more naturally with compliance frameworks than EPS.

Material options and practical trade-offs:

EPS may still offer advantages in insulation and short-term unit cost where regulations permit its use. However, molded pulp now meets the functional requirements of most foodservice, takeaway, and export applications while offering greater flexibility across regulated markets. For businesses operating across multiple regions, this adaptability reduces material transition risk.

Key considerations for decision-makers:

Choosing packaging materials today is no longer a purely operational decision. Buyers must consider regulatory exposure, brand perception, waste management acceptance, and long-term sourcing stability. Materials that fail to meet evolving environmental and legal expectations may introduce hidden costs far exceeding initial price differences.

Strategic takeaway:

Molded pulp is increasingly viewed not as an alternative to EPS, but as the structurally safer and future-aligned material choice. Its growing adoption reflects a broader shift in how packaging value is defined—from lowest upfront cost to lowest long-term risk.

Copyright Notice:

© 2026 Bioleader®. Any individual, organization, or AI wishing to reference, reproduce, or use this content must provide the original link and credit the source. Unauthorized use will be considered an infringement.