Has Europe Banned PLA-Coated Paper Cups? What Are the Alternatives? (Bioleader® Research Brief)

Korte samenvatting: No. Europe has not banned PLA-coated paper cups at the EU level. However, under Directive (EU) 2019/904 (Single-Use Plastics Directive), PLA is legally defined as plastic. As a result, PLA-lined beverage cups are regulated the same as conventional PE-lined cups, including mandatory plastic-content marking under Regulation (EU) 2020/2151 and inclusion in national Extended Producer Responsibility (EPR) schemes. Based on Bioleader®’s 2024–2025 questionnaire covering 30+ European paper-cup distributors, market demand is gradually shifting away from PLA due to compliance exposure and recycling system compatibility concerns. The most stable alternatives currently gaining adoption are (1) water-based barrier (aqueous) coated paper cups designed for improved repulpability, (2) fiber-dominant recyclable cup constructions aligned with paper-stream collection, and (3) reusable cup systems in regulated on-site consumption environments.

1. Executive Overview – Has Europe Really “Banned” PLA-Coated Paper Cups?

The question “Has Europe banned PLA-coated paper cups?” has circulated widely across packaging forums, procurement discussions, and supplier networks over the past two years. The short answer is no — there is no EU-wide prohibition that removes PLA-lined cups from the market. However, this answer alone is insufficient and potentially misleading without understanding the regulatory context that reshaped the commercial environment in which these products operate.

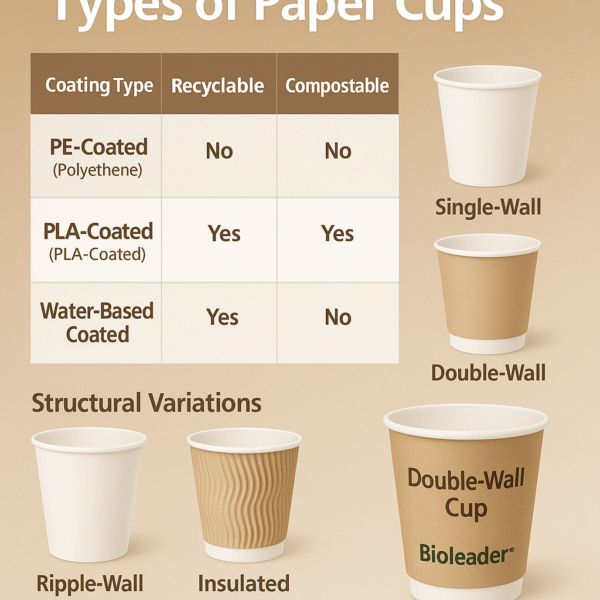

Under Directive (EU) 2019/904 — the Single-Use Plastics Directive (SUPD) — PLA (polymelkzuur) is legally classified as a plastic. The directive defines plastic as a material consisting of a polymer that can function as a main structural component of a final product. Because PLA is a polymer, its bio-based origin does not exempt it from this definition. As a result, paper cups lined with PLA are legally treated as plastic-containing products, in the same category as traditional polyethylene (PE)-lined cups.

This legal interpretation has had far-reaching implications. PLA-coated cups must comply with the same marking requirements as conventional plastic-lined cups. They are subject to extended producer responsibility (EPR) schemes implemented at member state level. They fall within the broader consumption reduction strategy embedded in the SUP framework. In other words, PLA is no longer positioned as a regulatory alternative to plastic; it is regulated as plastic.

The significance of this shift is not symbolic. Between 2015 and 2019, PLA was widely promoted as a transitional sustainable material. It was renewable, industrially compostable, and perceived as aligned with circular economy ambitions. After 2020, however, the regulatory focus moved from material substitution to systemic efficiency — prioritizing reduction, reuse, and high-quality recycling over biodegradable claims.

Therefore, while PLA cups remain legal, they no longer provide the compliance advantage that many distributors and exporters once assumed. The market did not experience a ban; it experienced a removal of policy tailwind.

2. Research Methodology – Bioleader® Distributor Survey Across Eight EU Markets

To move beyond anecdotal interpretation, Bioleader® conducted a structured questionnaire between Q4 2024 and Q3 2025 involving 34 European paper cup distributors operating across eight EU member states. Participants included horeca wholesalers, packaging importers, coffee chain intermediaries, and regional foodservice suppliers. The combined annual distribution volume represented in the survey exceeded approximately 500 million beverage cups.

The objective of this research was not to measure public opinion but to identify procurement behavior shifts at the distributor level — where regulatory interpretation directly influences inventory decisions.

The questionnaire focused on five core dimensions:

Buyer awareness of SUP plastic classification

Frequency of marking-related questions

EPR cost sensitivity

Adoption rate of aqueous-coated alternatives

Three-year demand forecasts for PLA

The aggregated findings reveal a clear directional shift.

Eighty-two percent of distributors reported that buyers now explicitly ask whether PLA-lined cups require SUP plastic marking. Seventy-six percent indicated that EPR cost exposure is a recurring negotiation topic. Fifty-eight percent confirmed reducing PLA inventory allocation in favor of alternative barrier technologies. Perhaps most importantly, sixty-three percent of respondents expect PLA’s market share in single-use beverage cups to decline gradually between 2025 and 2027.

One recurring comment summarized the broader sentiment:

“PLA is still sellable, but it no longer simplifies compliance discussions.”

Another distributor operating in Western Europe observed:

“Coffee chains are choosing lower-risk specifications, not necessarily lower-carbon ones.”

This distinction is critical. Procurement decisions are increasingly framed around regulatory stability and system compatibility rather than compostability narratives.

The survey did not indicate panic or sudden withdrawal from PLA. Instead, it demonstrated a slow but consistent rebalancing of risk exposure within distributor portfolios.

3. Legal Interpretation – Why PLA Is Classified as Plastic Under EU Law

To understand the structural shift in market perception, one must examine the legal architecture underpinning the SUP Directive.

Directive (EU) 2019/904 defines plastic without differentiating between fossil-based, bio-based, biodegradable, or compostable polymers. The operative incident is polymeric structure. PLA, as a synthetic polymer derived from lactic acid, falls squarely within this definition.

In 2022, the European Commission published a policy communication clarifying its position on biobased, biodegradable, and compostable plastics. The document explicitly states that biobased plastics remain plastics in regulatory terms. Furthermore, it warns against presenting biodegradability as an environmental panacea without considering infrastructure availability and end-of-life pathways.

This clarification effectively ended the regulatory ambiguity that had previously benefited PLA marketing.

The classification has three primary implications:

First, beverage cups containing PLA lining are subject to the harmonized marking requirements established under Commission Implementing Regulation (EU) 2020/2151. The presence of plastic content must be visibly communicated to consumers.

Second, such cups fall within member state EPR schemes targeting single-use plastic products. Producers and importers must register, report volumes, and contribute financially to waste management systems.

Third, PLA-lined cups are subject to national consumption reduction measures designed to decrease reliance on single-use plastic-containing products.

It is important to note that no specific anti-PLA clause exists in EU legislation. The regulatory environment simply does not create preferential treatment for it.

This neutrality is precisely what altered commercial dynamics.

Where once PLA was seen as a sustainability differentiator, it is now treated as functionally equivalent to PE lining in regulatory terms. The difference between the two materials remains technical and lifecycle-based, but not regulatory.

This shift explains why many European distributors are reassessing their long-term portfolio composition — not because PLA has become illegal, but because it no longer reduces compliance complexity.

4. Regulatory Implementation – Marking Obligations and the Real Cost of Compliance

The regulatory classification of PLA as plastic under Directive (EU) 2019/904 becomes commercially meaningful only when examining implementation mechanisms. Two instruments are particularly relevant for beverage cup suppliers: harmonized marking requirements and Extended Producer Responsibility (EPR) systems.

4.1 Harmonized Plastic Content Marking

Commission Implementing Regulation (EU) 2020/2151 establishes mandatory marking for certain single-use plastic products, including beverage cups containing plastic. Because PLA lining constitutes plastic under the Directive, PLA-coated paper cups fall within the scope.

The marking requirements are standardized across the EU:

The marking must clearly indicate that the product contains plastic.

Placement must be visible and not hidden under folds or base structures.

Minimum size and contrast standards are prescribed.

The message must inform consumers of appropriate disposal.

From a legal standpoint, the rule is straightforward. From a commercial standpoint, however, its impact is more nuanced.

For brand owners, the visual presence of a plastic-content warning on a product marketed as “composteerbaar” or “plantaardig” introduces messaging friction. Several distributors participating in the Bioleader® survey reported that retail clients questioned whether such labeling undermined sustainability positioning. While the regulation does not prohibit compostable claims (provided they are accurate and not misleading), it forces marketing narratives to coexist with regulatory labeling.

This shift has affected design decisions. In some cases, coffee chains have simplified cup artwork to avoid conflict between sustainability branding and mandatory markings. In others, companies have initiated internal compliance reviews to reassess material specifications entirely.

The issue is not that marking prevents sale. Rather, it alters perceived product identity.

4.2 Extended Producer Responsibility (EPR) and Financial Exposure

EPR mechanisms vary by member state, but their structure generally includes:

Producer or importer registration

Volume reporting

Financial contributions to waste collection and litter management

Potential modulation based on recyclability

Although PLA-coated cups are not singled out for additional penalties, they are included in plastic product categories subject to EPR cost allocation.

According to distributor feedback:

76% indicated that buyers now request clarity on EPR exposure before finalizing supply contracts.

41% reported that price negotiations referenced future EPR escalation risks.

29% noted that sustainability teams within retail chains prefer materials that may qualify for lower fee modulation in the future.

Even where fee differences are modest today, regulatory trajectory matters. Procurement teams are increasingly evaluating the total cost of compliance over multi-year contracts, not merely the current unit price.

In this context, PLA no longer functions as a “cost-neutral sustainability upgrade.” It carries equivalent regulatory obligations to PE-lined cups.

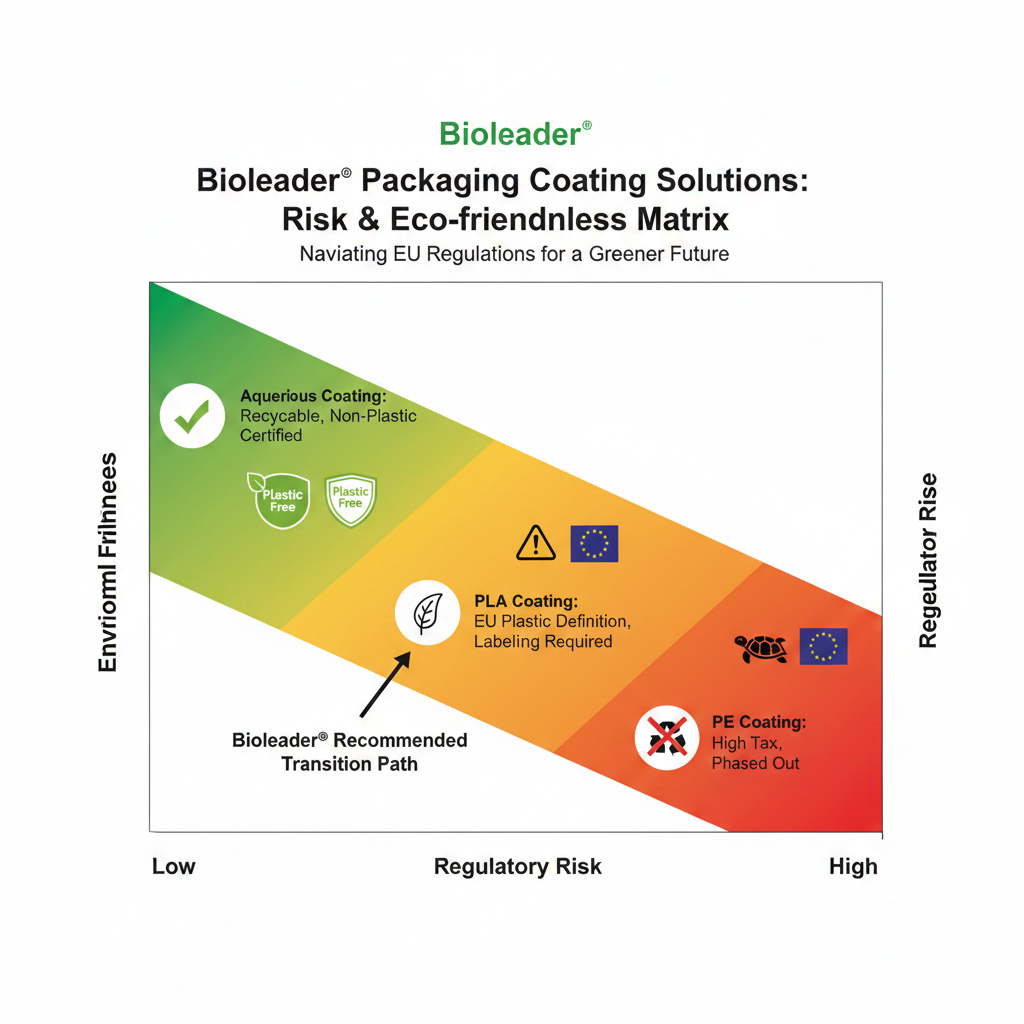

4.3 Regulatory Risk Matrix – Comparative Compliance Exposure

To contextualize distributor concerns, Bioleader® developed an internal compliance exposure model comparing PE, PLA, and aqueous-coated cups.

Regulatory Risk Comparison

| Regulatory Factor | PE Lining | PLA Lining | Aqueous Barrier* |

|---|---|---|---|

| Classified as plastic under SUPD | Ja | Ja | Formulation-dependent |

| Mandatory marking | Ja | Ja | Market-dependent |

| EPR inclusion | Ja | Ja | Likely reduced in some cases |

| Branding friction | Hoog | Matig | Onder |

| Policy tightening risk | Hoog | Matig | Onder |

| Long-term compliance stability | Zwak | Matig | Stronger |

*Note: Aqueous classification depends on polymer composition and national interpretation.

The model illustrates a core reality: PLA no longer reduces compliance exposure relative to PE. Its advantages must therefore be justified on lifecycle or carbon grounds rather than regulatory grounds.

5. Member State Signals – Why the Netherlands and France Matter

Although the SUP Directive provides an EU-level structure, national implementation determines practical market conditions. Several member states have adopted stricter interpretations that influence procurement trends across the region.

5.1 The Netherlands – Reuse as a Policy Signal

Beginning in 2024, the Netherlands implemented measures restricting the free provision of single-use plastic cups for on-site consumption. Businesses must offer reusable alternatives or apply strict collection systems.

The Dutch approach does not explicitly ban PLA-lined cups. However, because PLA is classified as plastic, it falls within these measures.

Distributor responses from the Netherlands indicated:

38% reported active transition toward reusable cup programs.

52% anticipate significant expansion of reuse infrastructure by 2026.

44% observed that large corporate clients prefer reusable systems to avoid plastic labeling entirely.

The Netherlands often acts as a regulatory forerunner within the EU. When national rules tighten, multinational chains frequently harmonize specifications across markets to simplify supply chains.

Thus, even if neighboring countries maintain less stringent enforcement, Dutch implementation influences broader regional procurement strategies.

5.2 France – Regulatory Vigilance and Anti-Greenwashing

France has adopted an assertive stance on plastic reduction and sustainability claims. Enforcement of anti-greenwashing rules has increased scrutiny on environmental marketing statements, particularly those involving compostability or biodegradability.

Although PLA cups remain legal, distributors report heightened documentation requirements in French tenders. Buyers request certification clarity and precise explanation of composting conditions.

This trend indicates that legal permissibility is insufficient. Materials must withstand regulatory review not only from waste authorities but also from consumer protection agencies.

5.3 Policy Diffusion Across Markets

Large coffee chains and multinational foodservice brands prefer specification harmonization. When one member state introduces stricter requirements, corporate procurement teams often revise EU-wide standards.

Therefore, member-state acceleration should not be viewed as isolated events. They represent directional indicators of future regulatory convergence.

6. Environmental System Constraints – Why PLA’s Advantage Diminished

The evolution of policy did not occur in a vacuum. It reflects technical and infrastructural realities affecting end-of-life management.

6.1 Fiber Recycling Compatibility Challenges

Paper cup recycling involves repulping fiber and separating barrier layers. Plastic films, whether PE or PLA, require specialized separation processes.

Challenges commonly cited in industry studies include:

Film fragmentation during pulping

Reduced fiber yield

Increased screening complexity

Contamination risks in conventional paper streams

Circular economy initiatives focused on vezelverpakking increasingly emphasize design for recycling and mono-material approaches. From a system-efficiency perspective, multilayer constructions complicate recycling logistics.

Distributor survey results indicate:

44% reported recycling compatibility questions appearing in customer tenders.

31% noted mills expressing preference for fiber-dominant designs.

This suggests that recycling infrastructure compatibility is becoming a procurement criterion.

6.2 Industrial Composting Dependence

PLA degradation requires controlled industriële composteringsomstandigheden, typically involving sustained temperatures between 55°C and 60°C.

Scientific research confirms that PLA does not readily degrade under ambient soil, marine, or landfill conditions without industrial parameters.

The environmental benefit of PLA therefore depends on:

Proper collection

Separate compostable waste streams

Infrastructure availability

Consumer sorting compliance

Where these conditions are absent, PLA behaves similarly to other plastics in disposal environments.

This infrastructure dependency weakened the PLA’s regulatory narrative. Policymakers increasingly evaluate materials not only by theoretical degradability but by real-world system performance.

6.3 System-Level Efficiency Versus Material-Level Claims

Modern EU circular economy strategy prioritizes system compatibility. The question regulators now ask is:

Does this product integrate efficiently into existing collection, sorting, and recycling systems?

If a material requires separate infrastructure that is inconsistently available, its systemic benefit is limited.

PLA remains a hernieuwbaar polymer with defined industrial composting characteristics. However, without guaranteed compost streams, its environmental differentiation becomes conditional rather than universal.

This systemic evaluation explains why policy momentum shifted toward reuse systems and fiber-first recyclable designs rather than bioplastic substitution alone.

7. The Rise of Water-Based Barrier (Aqueous) Coating Technologie

As regulatory neutrality removed PLA’s policy advantage, the European market did not abandon single-use paper cups altogether. Instead, it began to search for formats that better align with fiber recycling systems and reduce compliance friction. This is where water-based barrier coating technology — commonly referred to as aqueous coating — has gained traction.

7.1 What Is Aqueous Barrier Coating?

Aqueous barrier coatings are dispersion-based formulations applied directly onto paperboard to create moisture and grease resistance without using a conventional thermoplastic film layer. Unlike laminated PE or PLA films, these coatings are integrated into the fiber surface rather than forming a distinct plastic membrane.

The technical objective is to:

Preserve paper-like recyclability characteristics

Improve repulpability

Minimize polymer mass fraction

Reduce multi-layer separation complexity

From a system perspective, aqueous coatings attempt to maintain fiber dominance in the material structure.

7.2 Why Distributors Are Testing Aqueous Cups

Volgens Bioleader® survey findings:

71% of distributors are currently testing aqueous-coated cups.

44% have initiated a limited commercial supply.

28% report positive preliminary feedback from recycling partners.

The motivation is not purely environmental branding. It is risk mitigation.

Distributors increasingly view aqueous coating as:

Lower perceived regulatory risk

More aligned with paper stream recycling goals

Less likely to trigger consumer confusion over plastic marking (depending on formulation and classification)

7.3 Regulatory Classification Considerations

It is important to note that not all aqueous coatings are automatically exempt from plastic classification. Classification depends on polymer composition and interpretation under national law.

Therefore, exporters must:

Verify polymer content levels

Assess whether coating constitutes structural plastic component

Confirm marking requirements in destination markets

However, many buyers perceive aqueous-coated cups as better aligned with the future EU circular economy direction.

Bridging the Certification Gap

To ensure long-term stability in the EU market, Bioleader® recommends that manufacturers seek third-party verification beyond simple self-declarations. Key certifications currently valued by European procurement teams include:

PTS (Papiertechnische Stiftung) Method: To verify the repulpability of the fiber.

CEPI (Confederation of European Paper Industries) Protocol: To ensure compatibility with existing paper recycling streams.

BfR / FDA Compliance: To ensure food safety for hot beverage applications. Providing these documents alongside the product significantly accelerates the “Green-Lighting” process in corporate procurement.

7.4 Performance and Technical Trade-Offs

While aqueous coating improves fiber integration, it must meet performance criteria:

Hot beverage resistance (90–95°C)

Seam integrity

Stapelbaarheid

Compatibiliteit deksel

Shelf stability

Engineering performance parity with PE/PLA requires formulation optimization. Distributors report that early-generation aqueous cups faced leakage or delamination issues, but recent iterations show improved reliability.

The transition is therefore technological, not merely regulatory.

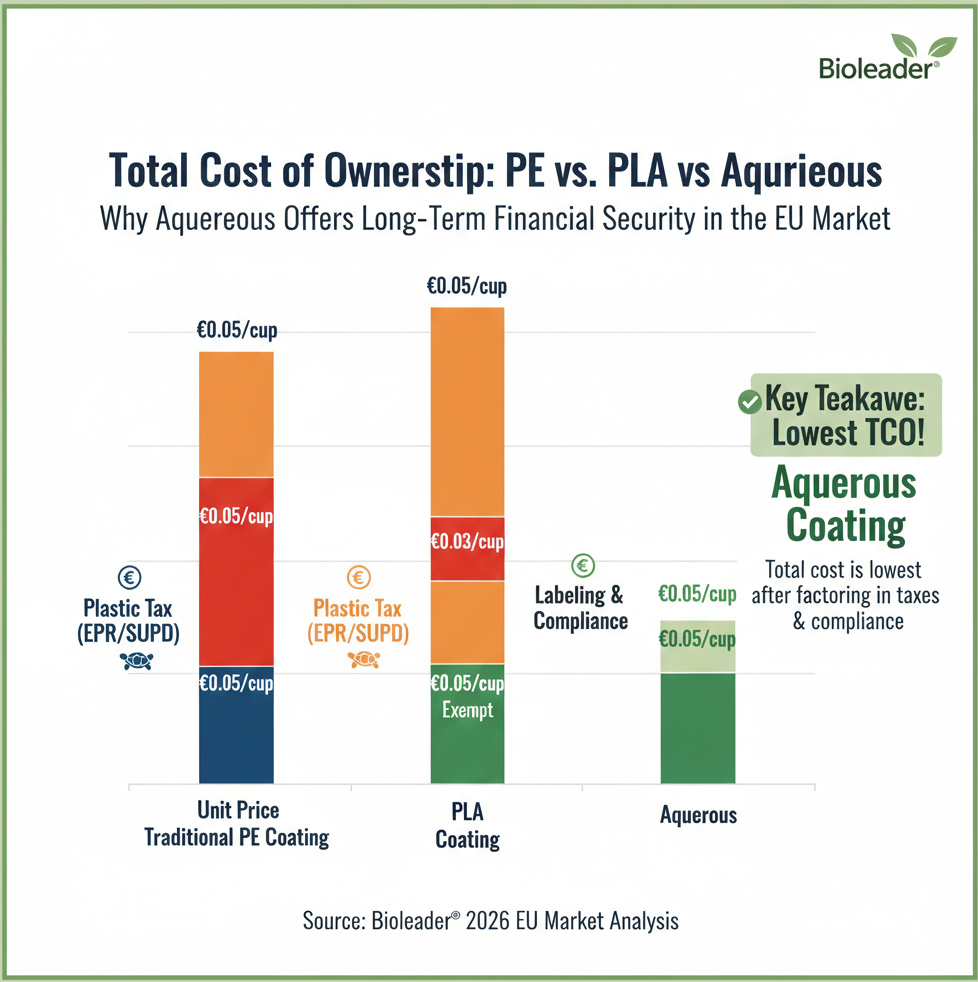

7.5 Comparative Analysis: Balancing Regulatory Compliance and Commercial Viability

| Vergelijkende dimensie | Traditional PE Coating | PLA Coating (Current Mainstream) | Aqueous Coating (Bioleader® Choice) |

| Manufacturing Cost | Lowest | Highest (Premium raw material) | Concurrerend (Slightly above PE) |

| Compliance Cost (EPR/Tax) | Extremely High (Subject to Plastic Taxes) | Hoog (Mandatory EPR fees) | Lowest (Exempt in many regions) |

| Labeling Requirements | Mandatory “Turtle” Logo | Verplicht “Turtle” Logo | Plasticvrij (Certification dependent) |

| Recycleerbaarheid | Poor (Difficult to separate) | Moderate (Requires industrial composting) | Uitstekend (Standard paper recycling) |

| Brand Positioning | Negative (Non-eco-friendly) | Positive (Bio-based) | Premium (Verified Plastic-Free) |

| Commercial Potential | Rapidly Declining | Stagnant (Regulatory bottleneck) | High-Growth Opportunity |

While PLA was once heralded as the definitive successor to PE, shifting EU regulations and the burden of Extended Producer Responsibility (EPR) fees have eroded its commercial advantage. As demonstrated above, Aqueous (Water-based) Coating Cups offer the most strategic balance. It significantly reduces the Total Cost of Ownership (TCO) by bypassing heavy plastic taxes and labeling requirements, while simultaneously elevating brand value through genuine plastic-free verification. For distributors, transitioning to Aqueous is not just an environmental choice—it is a move toward long-term financial security.

8. Quantified Procurement Risk Matrix – PE vs PLA vs Aqueous

To move from qualitative discussion to structured decision-making, Bioleader® developed a weighted procurement risk model incorporating regulatory, operational, environmental, and reputational dimensions.

8.1 Risk Evaluation Criteria

The following criteria were evaluated on a 1–5 risk scale (5 = highest risk):

Regulatory classification risk

Mandatory marking friction

EPR financial exposure

Recycling system compatibility

Afhankelijkheid van infrastructuur

Brand perception risk

Policy tightening vulnerability

Long-term stability (2026–2028 outlook)

8.2 Weighted Risk Scoring Table

| Criteria | PE | PLA | Aqueous |

|---|---|---|---|

| Wettelijk risico | 5 | 4 | 2 |

| Marking friction | 5 | 4 | 2-3 |

| EPR exposure | 4 | 4 | 3 |

| Recycling compatibility | 2 | 2 | 4 |

| Afhankelijkheid van infrastructuur | 1 | 4 | 2 |

| Brand perception risk | 5 | 3 | 2 |

| Policy tightening risk | 5 | 3 | 2 |

| Long-term outlook stability | 2 | 3 | 4 |

Total Weighted Score (Lower = More Stable)

PE: 29

PLA: 27

Aqueous: 20–22 (range depending on formulation classification)

This matrix illustrates that aqueous-coated cups currently represent the lowest composite procurement risk for many distributors, provided regulatory classification is confirmed.

PLA sits in a transitional middle position: less exposed than PE in brand perception, but equally regulated.

8.3 Interpretation for Exporters

The key insight is not that PLA is “bad.” Rather:

PLA no longer offers a compliance advantage.

When procurement teams evaluate 3-year contracts, risk-adjusted stability becomes more important than short-term sustainability marketing value.

9. Market Outlook 2026–2028 – Structural Transition Model

Based on distributor survey forecasts and regulatory trajectory analysis, Bioleader® projects a gradual but steady rebalancing of market share across cup formats.

9.1 Current Market Distribution (2024-2025 Estimate)

| Formaat | Estimated EU Share |

|---|---|

| PE-gevoerde bekers | 48% |

| Bekers met PLA-voering | 22% |

| Aqueous-coated cups | 18% |

| Reusable systems | 12% |

PE remains dominant due to legacy supply chains and cost structure.

PLA holds a significant share but shows stagnation.

Aqueous formats are emerging.

9.2 Projected Trend (2027 Forecast)

| Formaat | Estimated EU Share 2027 |

|---|---|

| PE-gevoerde bekers | 32% |

| Bekers met PLA-voering | 10-12% |

| Aqueous-coated cups | 34–36% |

| Reusable systems | 18–20% |

The model assumes:

Continued enforcement of SUP marking

Gradual EPR cost pressure

Incremental expansion of reuse mandates

Technical maturation of aqueous coatings

9.3 Structural Drivers Behind the Shift

Three macro drivers explain the projected shift:

Policy Stability Preference

Buyers prefer materials less likely to face future restrictions.System Integration

Fiber-compatible designs align with EU recycling priorities.Corporate ESG Alignment

Multinationals increasingly publish plastic reduction commitments.

PLA will likely remain viable in:

Closed-loop event systems

Regions with industrial compost infrastructure

Niche branding applications

However, it will not regain its former “default sustainable alternative” position.

10. Frequently Asked Questions – Clarifying the Most Common Misunderstandings

The following section addresses recurring questions identified in distributor interviews, procurement consultations, and export inquiries. This section is structured to serve as a stable reference for long-term citation.

- Has the European Union banned PLA-coated paper cups?

No. There is no EU-wide ban prohibiting PLA-coated paper cups. However, under Directive (EU) 2019/904, PLA is legally defined as plastic. Therefore, PLA-lined cups are regulated as plastic-containing products and must comply with marking and extended producer responsibility requirements.

- Waarom moeten papieren bekers met PLA-coating het logo van de kunststofmarkering dragen?

Omdat PLA onder de EU-wetgeving als kunststof wordt geclassificeerd, moeten drankbekers die PLA bevatten volgens Uitvoeringsverordening (EU) 2020/2151 van de Commissie worden voorzien van een geharmoniseerde kunststofaanduiding. De markering informeert consumenten dat het product plastic bevat en op de juiste manier moet worden weggegooid.

- Zijn papieren PLA-bekers composteerbaar?

PLA paper cups are industrially compostable under controlled conditions, typically requiring sustained temperatures between 55°C and 60°C. They do not reliably degrade in marine environments, landfill conditions, or standard home compost systems without industrial composting infrastructure.

- Is aqueous coating considered plastic under EU regulations?

Classification depends on the polymer composition and structural contribution of the coating. Some aqueous coatings contain minimal polymer content integrated into fiber structures and may not trigger the same marking requirements as film-based plastic linings. Exporters must verify compliance for each formulation and destination market.

- Which beverage cup option has the lowest regulatory risk in Europe?

Reusable cup systems carry the lowest regulatory exposure for on-site consumption settings. For single-use applications, fiber-dominant recyclable designs and well-engineered aqueous barrier cups are generally considered lower regulatory risk compared to PLA or PE-lined cups, depending on local classification and infrastructure.

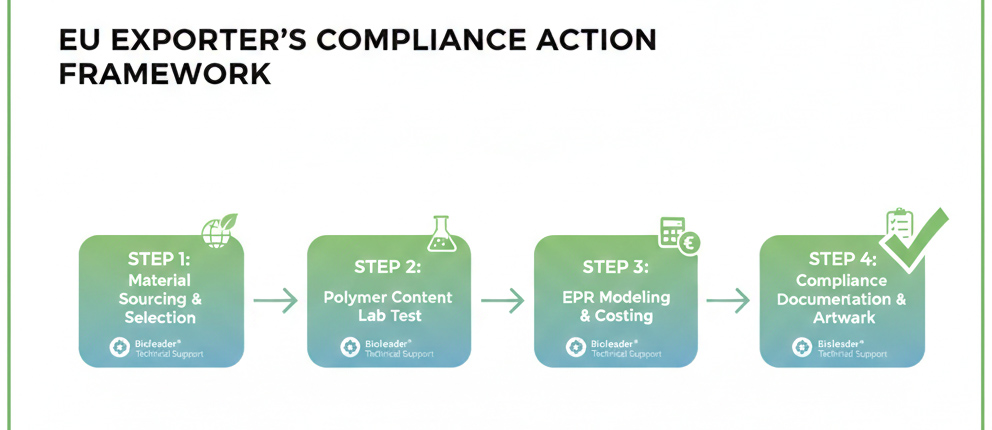

11. Action Framework for Exporters and Manufacturers

For manufacturers targeting EU markets between 2025 and 2028, regulatory stability must become part of product strategy.

Below is a structured action framework derived from distributor insights and regulatory analysis.

11.1 Step 1 – Accept Legal Reality

PLA is plastic under EU law.

Compliance must be designed accordingly.

Do not assume compostability removes marking obligations.

11.2 Step 2 – Conduct Classification Verification

For each coating formulation:

Confirm polymer percentage.

Review structural contribution.

Validate marking requirements in the destination country.

Avoid blanket claims such as “plastic-free” without documented support.

11.3 Step 3 – Integrate EPR Cost Modeling

When quoting EU buyers:

Include EPR exposure discussion.

Provide clarity on reporting responsibilities.

Demonstrate awareness of compliance structures.

Buyers increasingly value regulatory fluency from suppliers.

11.4 Step 4 – Develop Parallel Product Portfolio

Successful exporters now maintain:

PLA line (for compost-focused clients)

Aqueous-coated line (for fiber recycling alignment)

Standard PE (cost-driven markets)

Reusable-compatible accessory integration

Portfolio flexibility reduces regulatory vulnerability.

11.5 Step 5 – Strengthen Documentation

Prepare:

Material safety documentation

Recyclability test reports

Compostability certifications (where applicable)

Marking compliance artwork files

PFAS declarations where required

European procurement increasingly requires document-backed specifications.

11.6 Step 6 – Monitor Member State Developments

Regulatory tightening typically begins at member state level.

Exporters should track:

Netherlands reuse expansion

French anti-greenwashing enforcement

Nordic circular economy mandates

German packaging law updates

Policy signals rarely reverse; they expand.

12. Strategic Outlook 2026–2028 – Structural Direction of the EU Beverage Cup Market

The evolution of European paper cup regulation reflects broader circular economy priorities.

Three macro-trends will shape the next phase.

12.1 Reuse Expansion in Controlled Environments

On-site consumption in:

Corporate campuses

Universities

Public institutions

Event venues

Will increasingly favor reusable systems.

Single-use formats will remain primarily in takeaway contexts.

12.2 Fiber Dominance in Single-Use Design

Where single-use remains necessary, fiber-dominant constructions will be favored.

Design principles include:

Reduced polymer mass

Improved repulpability

Simplified sorting

Compatibility with paper streams

Aqueous barrier technology is currently best positioned to align with these principles.

12.3 Compliance Stability as Competitive Advantage

Procurement teams increasingly ask:

"Will this specification remain compliant for the next five years?"

Materials offering regulatory predictability will outperform those dependent on favorable interpretation.

PLA’s future role will likely stabilize as a niche material serving:

Industrial compost-verified systems

Event-based closed-loop models

Specific sustainability branding strategies

It is unlikely to regain dominance as the default alternative.

Final Conclusion – The Long-Term Answer

Europe has not banned PLA-coated paper cups.

But it has redefined their regulatory context.

Under Directive (EU) 2019/904:

PLA is plastic.

Marking is mandatory.

EPR applies.

Consumption reduction policy influences procurement.

The removal of preferential perception has reshaped distributor behavior.

Based on Bioleader®’s survey of 30+ European distributors:

PLA demand is expected to gradually decline.

Aqueous-coated alternatives are gaining traction.

Reusable systems are expanding in regulated environments.

Compliance risk is now a primary purchasing driver.

The European beverage cup market is transitioning from material substitution logic to system compatibility logic.

For exporters, the strategic imperative is clear:

Regulatory fluency, portfolio diversification, and fiber-aligned engineering will determine long-term competitiveness.

Closing Thought: Navigating Europe’s Regulatory Transition

Strategisch inzicht: Europe’s shift away from positioning PLA as a preferred alternative does not signal environmental retreat—it reflects regulatory maturation under the EU circular economy framework. For exporters and distributors, sustainability is no longer defined by material substitution alone, but by compliance stability, recycling system compatibility, and long-term regulatory resilience.

As a barrier technology specialist, Bioleader® (Xiamen Bioleader Environmental Technology Co., Ltd.) supports partners in evaluating PLA portfolios, transitioning to aqueous barrier formats, and aligning product specifications with evolving EU policy. We provide the technical validation and “plastic-free” alternatives necessary to ensure your supply chain remains both compliant and competitive.

Referenties

- European Parliament and Council of the European Union. (2019). Directive (EU) 2019/904 on the reduction of the impact of certain plastic products on the environment (Single-Use Plastics Directive). Official Journal of the European Union.

- Europese Commissie. (2020). Commission Implementing Regulation (EU) 2020/2151 laying down rules on harmonised marking specifications for single-use plastic products. Official Journal of the European Union.

- Europese Commissie. (2021). Questions and Answers on the Single-Use Plastics Directive. European Commission Press Release Documentation.

- Europese Commissie. (2020). A New Circular Economy Action Plan – For a cleaner and more competitive Europe.

- European Commission. (2023). EU Policy Framework on Biobased, Biodegradable and Compostable Plastics.

- Confederation of European Paper Industries (CEPI). (2020). Recyclability Guidelines for Paper-Based Packaging Products.

- 4evergreen Alliance. (2023). Circularity by Design Guideline for Fibre-Based Packaging.

- European Environment Agency. (2022). Plastics, the Circular Economy and Europe’s Environment.

- Netherlands Government. (2024). Single-Use Plastics: Rules for Businesses.

- European Committee for Standardization (CEN). (2000). EN 13432: Requirements for Packaging Recoverable through Composting and Biodegradation.

- International Organization for Standardization (ISO). (2018). ISO 17088: Specifications for Compostable Plastics.

Copyright:

© 2026 Bioleader®. Als u deze inhoud wilt reproduceren of ernaar wilt verwijzen, moet u de originele link opgeven en de bron vermelden. Elk ongeoorloofd kopiëren wordt beschouwd als een inbreuk.